Lower Commissions Means What?

Are Real Estate Agents going the way of the Dodo bird?

Some BIG NEWS in the Commission space!

What does it mean and is it a windfall for Sellers? Let's take a look.

Let's start with the headlines - the National Association of Realtors (NAR) last week agreed to settle a big lawsuit that alleged that NAR had conspired to set a standard 6% commission.

Commissions are a negotiable tool to pay for what you Need. Needs include robust marketing, negotiating for the highest price and best terms, clear communication, keeping an escrow on track, vetting buyers, and handling all the negotiation and legal documentation for Sellers. For Buyers, representing their best interest with regards to negotiating lowest price a seller will take, advising on types of inspections, and even providing a professional opinion that a house may not be the right one to buy (I've advised buyers in a professional capacity that a home that I can see has seller remedied electrical wiring may not be the best home to buy because we can't see inside the walls!) and for both buyers and sellers, advising on what they need to know about the contract because the purchase agreement all by itself is over 20 pages and that's not counting disclosures and addendums, reports, title company documentation, underwriting conditions, et cetera.

It is essential to understand that commission rates in real estate are always and have always been negotiable. Real estate commission rates are not fixed by law and are open to negotiation. Most sellers want the highest price for their homes and they know that they should pay for an experienced professional who provides the marketing and negotiation to get the highest price.

Prior to this settlement, there simply wasn't enough dialog about what a commission rate would buy a seller or why commissions were paid in the first place. In the California listing agreement, the amount charged is blank and must be filled in. Usually, half of the commission is offered to the Buyer's agent who brings a buyer who closes on the house. It's considered an incentivized tool to bring a large pool of qualified buyers. Buyer's agents vet buyers out of a very large pool of pajama-clad wanna-be home buyers surfing Zillow and Redfin. They show houses to buyers who have been pre-approved by a lender (and not just prequalified). They negotiate on the buyer's behalf not for the seller and they ensure that the buyer is meeting their terms of the contract and is in open communication with the listing agent to keep an escrow from falling off the rails.

It should be noted that commissions are the sum total of a real estate agent's income unlike an attorney who bills by the hour. Negotiating these rates involves understanding the value provided by the agent in terms of marketing strategies, negotiation skills, client relationships, the overall expertise in the real estate market, the community, as well as knowing the agent & broker's client base that trusts them to help them conduct a home transaction that is both a good value and protecting them legally and from scams.

Don't Pay the Buyer's Agents

There is a legal option not to pay a commission to the buyer's agent and that's perfectly OKAY. Here's how that might change things:

- If the seller isn't paying a buyer's agent commission, that likely will a) reduce demand from buyers with fewer buyers seeing the home for sale b) reduce the offer prices since buyers will factor that in c) produce more buyers going directly to the listing agent which is called dual agency. Dual agency may be considered legal but most sellers consider that a conflict of interest and do not want to have their agent represent both sides to the transaction. There's also limited negotiation leverage since the agent knows what each side wants but at the same time, must represent both parties. d) lastly, buyers may want to just represent themselves with no agent to represent them. It's not something I do without explaining to sellers that the risk is being transferred to them because buyers not being guided by an agent and an unrepresented buyer may decide to just pull out of the contract leaving the sellers high and dry.

- Buyer's agents may not show a house where there is no compensation being paid to them (aka commission). A Buyer who wants someone experienced to represent them must then pay for their own agent. This just means more money up front that the buyer doesn't always have. That too is negotiable. It still would have to be factored in to the buyer's financing and paying extra considering that there are now 3 commissions baked into the sale price (the listing agent's commission, the amount of the buyer's agent commission that the seller is now NOT paying but still wants, and the buyer paying for an agent to represent them.) = Seller Sales Price. At first blush, this seems like it will immediately impact buyers - I can see lawsuits of discrimination, more buyers will not be able to afford houses, and affecting both buyers and sellers, the market will initially not be transparent or efficient - if a buyer's commission is not shown on the MLS but it's paid, is the Sold price the comp or is a Sold Price that has no buyer commission a comp?

Technological Disruption

Silicon Valley and every tech entrepreneur would love to build an app that can completely replace the real estate agent and brokerages. Zillow has been trying and there are many more out there that will be incentivized to replace the agent. Technology has already had many impacts on the industry from making it more transparent to changing practices and structures and making it more efficient.

Technological advances may potentially impact commission rates. The current model incentivizes agents but the current model has the current commission rates built into the price of the home so it makes sense that if commissions were to go away or be drastically reduced, there likely will be or should be a corresponding reduction in home prices. And when things go wrong (as they often do, agents are fixing behind the scenes unbeknownst to the buying and selling parties), real estate attorneys are standing by to pick up the slack, for a fee.

I've been selling real estate for 9 years now. I came from the tech industry myself so I understand the concept of disruption. I think you'll agree that not all disruption makes us money or happy, think about the disruption to customer service when you now get to talk to a chat bot and you really need to talk to a person or smart home technology that makes your home devices more convenient but which now may include subscription fees or subscriptions to software instead of a download on your computer, EVs that require investments into home charging stations, "cord-cutting" that invariably leads to multiple subscriptions over cable. There's also a bit of a debate over AI.

Are Ken and Oppenheimer the same?

A house at $650,000 is not the same as a stock that can be traded in milliseconds. And unlike a share of a company, there is some additional value to owning a home - you can live in it, it may provide tax advantages, provides some stability and predictability in terms of housing costs, you can build equity, it's considered an inflation hedge meaning that property values increase over the long term, and there's emotional satisfaction with pride of ownership, belonging in a community, and an anchor of financial stability. You know that, so what's the point? Many articles argue that disruption changed the model for stock trading and they expect it to change the real estate model the same way! It's not an apples to apples comparison. I expect disruption will change the real estate model and I'm hopeful for positive changes. What I can say is that the changes should weed out the agents who don't provide value. There's a very low bar to entry, but the top agents earn their commissions with outstanding marketing, negotiation, client relationships, and adaptability.

There will always be a path for a seller to go the low cost model and there always has been. Can you say Craigslist? Just remember that we live in a litigious state and selling a stock is a lot different than selling your house - there are laws you can break selling your house that can get you sued unlike selling shares of stock.

Fees or Commissions?

We already have a whiff of how an "app" aka Corporate America will change things. Zillow made its debut as a broker and started buying and selling houses which they no longer do - why? Well, for one, they couldn't make an algorithm sophisticated enough to price a house properly, to negotiate with multiple buyers, and to ensure that the house didn't fall out of escrow - they outsourced to online title companies and hired brand new, inexperienced agents, but wait! Here's the best part, they CHARGED MORE than 6%. They just didn't call it commission. Anyone who's been to business school or worked in or near a corporation or who pays attention to stock should remember ONE THING - A corporation's purpose is to benefit shareholders. And so the bottom line is this - they may start with a teaser rate like your internet provider, but they aren't going to stay there. They have to make money for their shareholders. I've compared my 5% fee (split between myself and the buyer's agent) with Zillow's fees and Zillow was always more expensive. Zillow's advantage was they could potentially buy the home outright and hold it which they did on some of their purchases where the algorithm overrode human intelligence and real market data to pay considerably more for a house than it was worth. You REALLY needed to be a seller when they were overpaying - It was a bonanza, for the Sellers!

Speaking of stock and disruption, Zillow warned this month that, "if agent commissions are meaningfully impacted, it could reduce marketing budgets of real estate partners ...which could adversely affect our financial condition" Too bad, Zillow. I used to put my marketing budget of $5,000/mo on Zillow years ago because while they produced great results, they shifted adeptly to selling me mobile home leads. Maybe you should short sell Zillow (Z)? Just kidding. I can't advise on stock trading!! But not to worry, Homes.com has plans to spend $1 billion in advertising this year. It's advertising model is betting that buyers can go directly to the listing agent.

With all that said, homes will still be bought and sold while the market changes. I pride myself on being a digital marketing specialist, being a top negotiator, a full on communicator, someone that treats each client as my top priority because I really care about representing my clients to have the best result. I go the extra mile writing blogs (since 2017) that I do not get paid for that are designed to provide additional value outside of a real estate transaction so you'll stay abreast of news and laws that affect you as a member of this community whether you're a buyer, a seller, or just interested in getting news that is related to real estate. Sometimes it's to give another perspective as this article is designed to do. I don't sell my mailing lists and I don't subject you to ads on my website. I've assembled a smart team of capable individuals that I've vetted and that I trust that makes for a winning combination for you which is why I've adopted a new tagline - EXPERIENCE: The Difference.

If you have more questions, feel free to reach out.

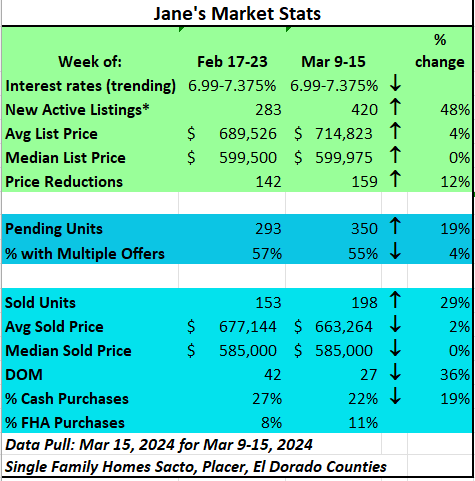

The market is still strong!

Jane