Buckle Up!

I hope you all had a lovely Thanksgiving! I had a nice one with my family.

2025 and What to Expect When You're Projecting!

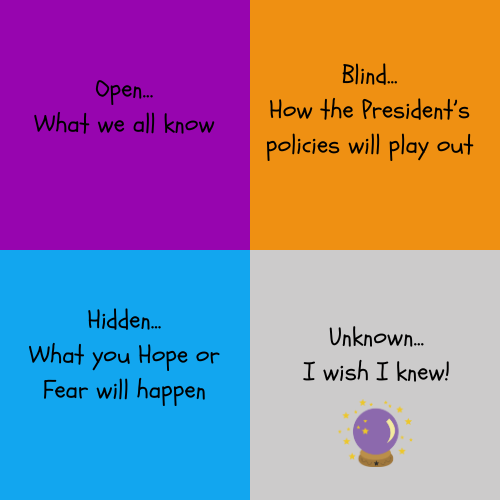

Okay so, there's some knowns and some unknowns. It reminds me of the Johari Window. You know, the one. 4 quadrants of self-awareness: one quad known to yourself and others, the blind spot quad which is unknown to you, but known to others, the hidden quad which is known to yourself but not to others, and the Unknown - which is unknown to you and to others. But what does it look like when we're trying to get some awareness of the 2025 housing market...?

Open:

Here's what we know today. The Fed recently threw a little caution to the wind by saying inflation had been a little higher than they initially expected, but that they were still planning to gradually cut rates. The Fed rates do not directly correlate with the mortgage rates. Rates are hovering still in the high 6% range.

Economists, focused on real estate, are all over the map now in their projections. The Mortgage Bankers Association (MBA) projects that mortgage rates will start the year lower at 6.2% and fall to 5.9% by the end of the year. Fannie Mae predicts a similar drop, from 5.9% to 5.6%. Redfin, on the other hand, forecasts that mortgage rates will remain in the high-6% range throughout 2025, with the weekly average fluctuating around 6.8%. So even if you aren't an economist, have a guess. Maybe in the 6% range?

Prices have pulled back a bit from their highs. Suppressed in large part due to the higher rates. Projections for 2025 are that prices should increase. All things being somewhat the same. We still have too few homes for buyers who want to buy and buyers are still out there!

Blind:

Now this is the quadrant where the President Elect's policies such as tariffs or mass deportations will impact housing, but we don't know how. Mass deportations may impact housing because according to estimates from the Center for Migration Studies (CMS), undocumented immigrants make up roughly 21% of California’s construction workforce.

Without that segment, there is an increased likelihood that labor costs will go up for new builds. As far as tariffs, roughly 15-30% of construction materials used in new home construction in the US is imported. The US imports a significant chunk of lumber, primarily from Canada - 25-30% is lumber acquired for the US residential housing market. So this will impact new construction, but won't have a significant impact on resale but it could have a big impact on remodeling costs.

The President Elect has spoken about wanting to lower interest rates and I can hear many buyers applaud that. It could be good but it could fan the embers of the inflation we just experienced. For sellers, that could bode well when you want to sell. Lower rates will drive higher prices. It's simply the supply demand balance. He has also signaled that he wants to reduce regulation and to get more houses built, this would be a great party favor.

Hidden:

Anyone thinking of making a move next year has some hopes and dreams. First time buyers want interest rates to be low and a decent supply of housing so they can get into their first home! People downsizing are looking for the price of their homes to be high and there to be an abundant supply of inventory to choose from when they buy. And, oh by the way, put low interest rates on the wish list for Santa! The fears may be the cause and effect of deregulated financial markets and just more of what we've had - low, low inventory and high interest rates. Whatever you personally crave or fear, it could happen. I mean, I believe anything now after COVID.

Unknown:

We all know that there will be changes as there always is with a new presidential administration. What we don't know is the impact of its policies. Let's face it, policy wonks can work out beautiful policies that aim to do wonderful things. Pull out the crystal ball, make a wish, say a prayer. I'm hoping for a robust real estate market in 2025 that benefits all my buyers and sellers!!

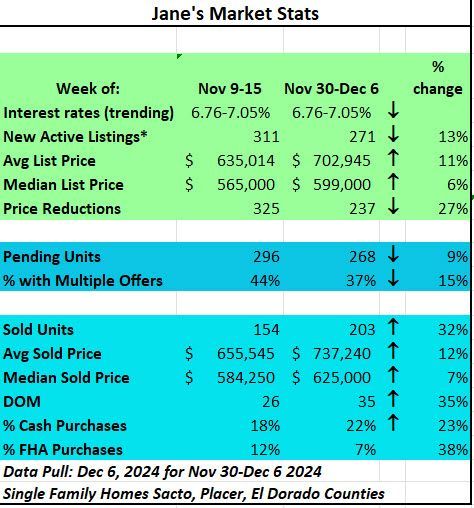

Here's a look at the Market stats this week. Less new listing which is perfectly normal this time of year. However the average list price and the average sold price went UP from a couple weeks ago. Cash is continuing to be a driver of the market and so are multiple offers.

My best wishes to each of you! Stay healthy! There's a bunch of viruses going around.