Trust me!

Listen up so this doesn't cost you (too much)

I just completed ongoing training to get my certification to handle probate and I'm going to lay out some basics that you might want to know to save you or your loved ones money.

The truth is, "We don't get out of here alive" (credit to Jim Morrison, Paul Newman, et al)

Do you have a living trust? Do your parents? You/they should if you own real property or anything of value. A revocable trust is a legal document that allows the creator (grantor) to transfer ownership of their assets to a trust while still retaining full control over them during their lifetime, meaning they can change the terms of the trust or revoke it entirely at any time; it's often used to avoid probate court and distribute assets to beneficiaries more privately after death.

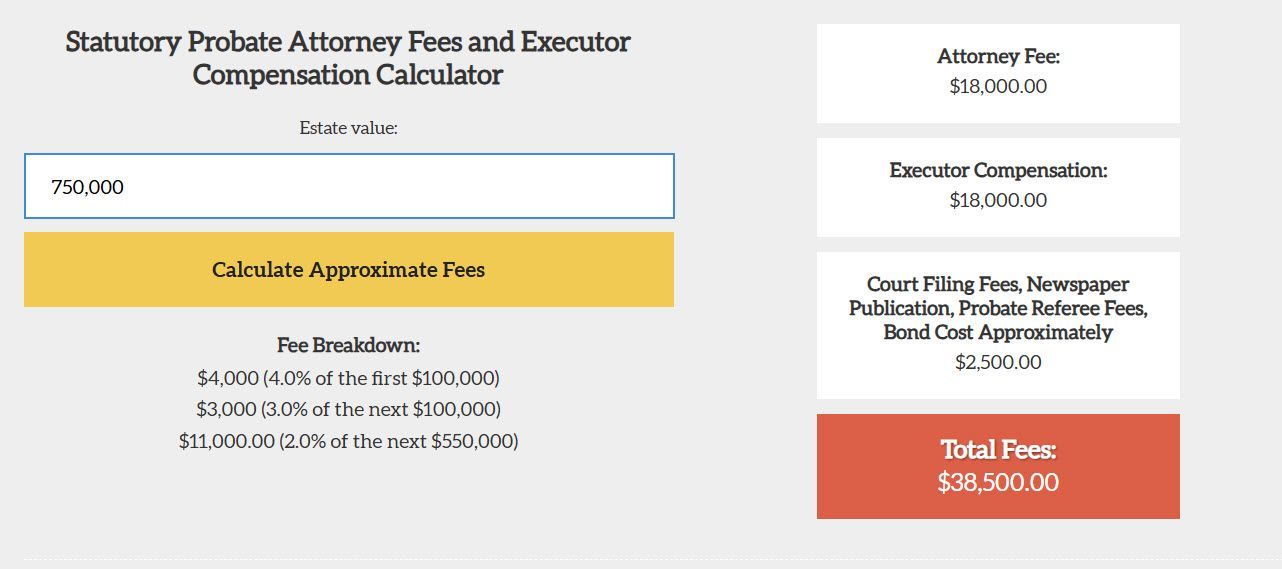

Sadly, it does cost money. Prices range from a legal specialist who can do one for a few hundred dollars to a Trust Attorney who likely will charge you a few thousand. Here's why it matters though. Generally speaking, a trust can help prevent a chunk of change being removed from the estate when you pass away. Here's a hypothetical:

Let's say your TOTAL estate value is $750,000 which is a conservative number because it includes your home. Nearly $40,000 can go to probate costs unlike a revocable trust which, if set up correctly, passes to the beneficiaries without cost, without a judge, and without a significant delay.

Say you have a will. Is that enough? NO. A will is merely a directive as to how your estate should be divided amongst your heirs. It still will need to go through Probate.

So what is Probate? Probate is the legal process of transferring a deceased person's assets to their beneficiaries. It involves identifying and valuing the deceased's assets, paying off any debts and taxes, and distributing the remaining assets.

Probate relies on the court system for court dates, people hired by the court such as a Probate Appraisal Referee who is responsible for assigning a fair value to the property or properties including non-cash assets (such as real estate, stocks, and personal property) and time. A house may be sold before the end of probate which can run a minimum of 9 months to a year or much longer, but the heirs won't be able to get the money until the probate is closed.

There is a new law in California that says Probate isn't required if real property used as a primary residence is less than $750,000 - but this is AFTER April 1, 2025. There's other exceptions and one I had to use with my mother was a Heggstad Petition which allows a real property to be added to back to a trust when it might have been taken out for a refinance.

The other thing that's certain are taxes. I wrote this before but it bears repeating. Do NOT add your beneficiaries to your deed. Why? Because they will not get the benefit of something called a stepped up tax basis. If you purchased your home for $200,000 and now it's worth $750,000 and you die, the IRS steps up the basis of your house to $750,000 and they don't tax you on the gains between $750,000 and the $200,000 BUT add a beneficiary sometime in there and you they no longer get the capital gains exemption. It's a nasty surprise to have to pay taxes on capital gains on real estate that has appreciated greatly over the years.

****************************

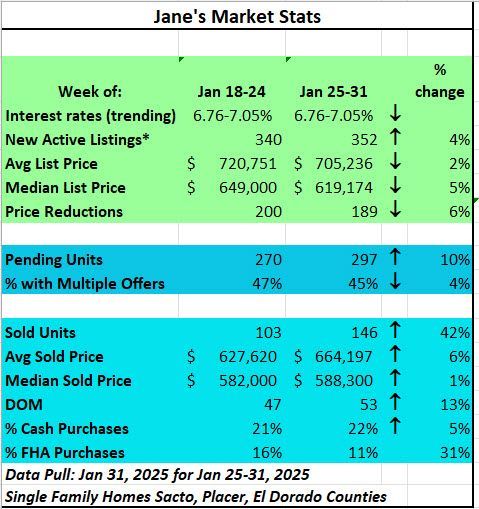

As far as the market, we're heating up but not in a crazy way. More listings are coming on but they are taking a bit longer to sell. Interest rates are not coming down right now. Some think they're going to come down this year, but there's many who don't see them going down. These aren't the highest rates we've ever seen. In the late 1970's, they reached 18%, but these are feeling a bit anemic to us when our recent memory is 2-3%. BUYERS are still looking! If you're thinking about putting your home on the market, the early bird usually gets the most money!

********************************

Hope you have a great weekend!

Do you know someone who would like to get my blog about the real estate market? If so, forward them this email and they can subscribe HERE!

Jane Gray

Owner Broker

916.293.1734

JaneGrayRealEstate.com

Jane@JaneGrayRealEstate.com

CADRE#01973665