The Family Trust

The Family Trust

It’s long been known that generational wealth unlocks doors – to opportunities and also to homes. Chances are your family didn’t bestow generational wealth on you to get into the best schools and the best homes. I wasn’t born into the 1% but if you are, kudos to you for being so lucky!

Regardless of our station in life as parents (or grandparents), we usually want our children to enjoy some of the economic rights of passage that we’ve been fortunate to have – buying a house, getting an education, and/or just being prepared to earn a decent living.

There’s many that will argue that it’s no different now than what it was many years ago, but I find that argument rings very hollow. We’re just not going to take sides here. I’ve talked to many adult children who feel the economic pinch and many a parent that sees it too. Becoming a homeowner has become especially difficult.

Many millennials I’ve helped have had help from an inheritance from a parent or grandparent dying, they’ve managed to save for a down payment (no small feat), or they’ve gotten help through a living relative – usually a parent in the form of a gift for a down payment, being a guarantor, being a co-owner, or providing loans.

Some refer to this living help as the Bank of Mom and Dad, but I like to think of it as the Family Trust. The definition of this trust is not the strict legal term but derives from these dictionary definitions: noun: the state of being responsible for someone or something. Verb: commit (someone or something) to the safekeeping of. But strikingly similar is the definition of a legal trust that acts as an arrangement whereby a person holds property as its nominal owner for the good of one or more beneficiaries.

Look, I get it. Not all parents think one or more children deserve their trust because they haven’t shown good financial habits. I have one who is only now beginning to apply fiscal prudence to his life. But let’s say that you have a child that has demonstrated solid management of his/her own personal finances.

You also probably have understood the good fortune to have purchased your own home when they were considerably cheaper than they are now and you’ve watched that purchase build your own wealth. Each mortgage payment along with appreciation, and the ability to utilize the deductions on your taxes have built a slow but steady accumulation of equity and personal wealth and stability that renters don’t generally have.

So how do you help that child get their first foothold on the ladder to homeownership? A good way to start is to ensure that they are saving and are living below their means. Age brings a certain amount of perspective and wisdom about the need to be prepared for the unexpected such as job losses, costly emergencies, and just bad breaks that can impact a budget. If you feel the finances are being managed well, then the next order of business is to determine if and how you think you want to help. Here’s how others have built the home trust for their children.

- Down payment assistance as a Gift with the following in mind for IRS purposes. There’s a limit and for 2024, the maximum gift is $18,000 per person. This means that mom can gift the son $18k, dad can also gift the son $18k. If the son is married, mom and dad can gift $18k each to the spouse for a total of $72,000 per year without any additional reporting requirements. Thanks Ryan Elmer, owner of My Innovative Tax for providing this information!

- Giving Loan Assistance by being a Guarantor or a Co-Signer. Both can help a borrower with low credit scores or limited credit.

- Guarantors agree to cover a borrower’s debt if they fail to pay what they owe, but are generally not responsible for repayment unless the borrower completely defaults. As a Guarantor, the person’s credit is not impacted unless there is a default.

- Co-signers are basically co-owners of the mortgage. The loan appears on the Co-signer’s credit report and late pays show up just as they would for the primary signer. Just like the Guarantor, the Co-signer is responsible if the borrower defaults.

- Giving a loan to a child is an option, but if it’s a loan, it must be factored into the debt to income ratios to ensure the borrower is able to repay

- Buying a house in the parents’ name and putting it in a trust for the child is a great option especially if the adult child isn’t necessarily settled. In this case, the child pays rent for a house that they will own when the parents pass away. A word of caution – despite best intentions and love for your child, it’s best to pay an attorney to write the terms of the agreement.

These are high level options and each individual should consider their specific situation and consult qualified tax and legal persons. I’ve seen each of them done successfully as well to help an adult child start on the first rung of homeownership.

There’s also parents who buy rental properties when their kids are young with the object being to pay for a child’s college education when it’s time. I also kick myself for not buying a condo in San Diego when my oldest went to college there. It always seems more expensive at the time, but in hindsight prices went up exponentially. Learn from my missed opportunity!

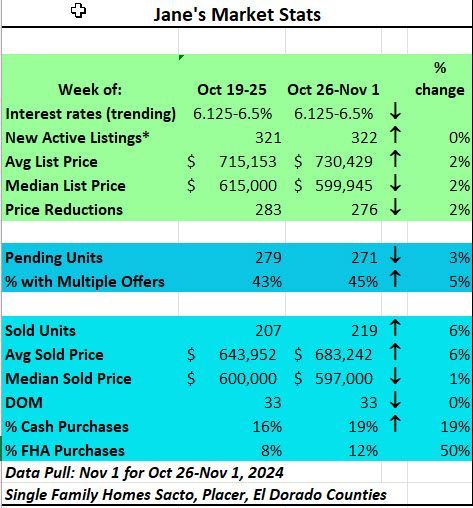

It's interesting how little the market changed since last week. I think everyone is holding their breath for the results of the election. Rates are holding steady as well but there is still movement. It's good to see FHA loans ticked up - that's a sign that first time home buyers are getting a foothold in the market possibly without family help.

****************************************

I'd like to put a plug in to visit one of my friend's apple pie shops in Camino in Apple Hill. She just purchased the Apple Pantry. Address is 2310 Hidden Valley Lane, Camino, CA 95709. Apple Hill is a wonderful place to go this time of year with the turning of the leaves and all things apples, spice, and everything nice! If you stop by, tell Gail that Jane sent you!

Have a great weekend!