But Wait!

But wait. Are mortgage rates going down?

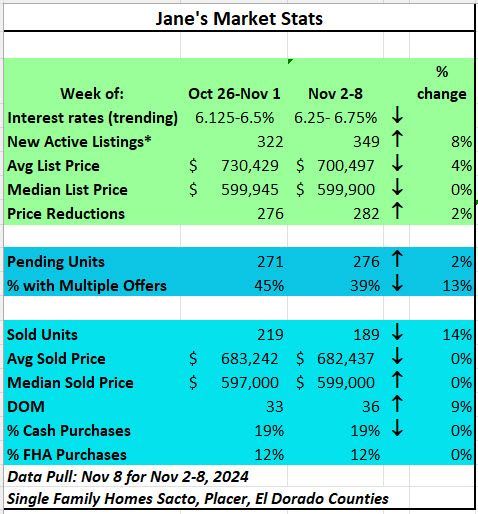

Yesterday, the Fed lowered the federal funds rate by a quarter of a point as was expected. Did they achieve the soft landing? With recent events, that’s still up for debate. Everyone waiting for the mortgage interest rates to drop saw the market hit the snooze button. Today, we’re seeing a range of 6.25-6.75% for mortgage rates. Still about twice what the gold rush of the Pandemic Years brought. So what gives?

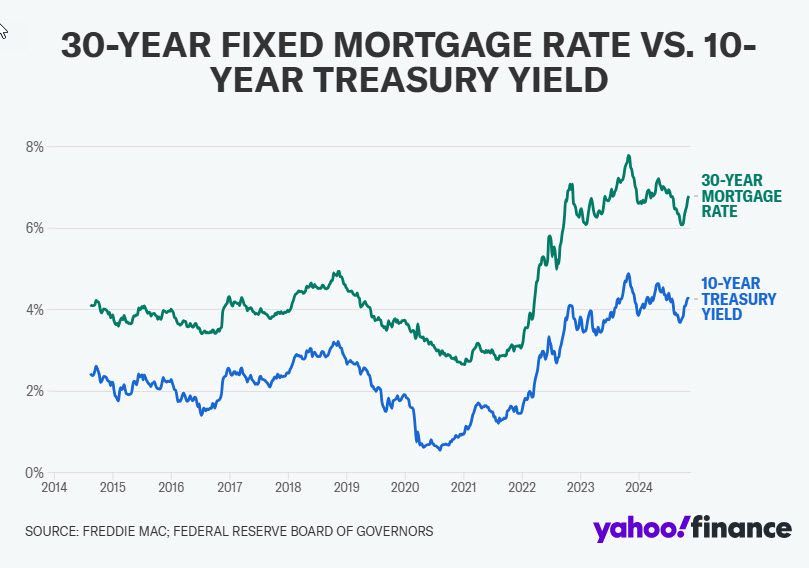

Let’s take a look at something that did happen. The US 10-year Treasuries went up after the election. Here’s why that matters. The US 10-year Treasury notes are a proxy for mortgage-backed securities. Historically, the 10-year Treasury tends to move in unison with mortgage interest rates as you can see in the graph below. Investors that tend to buy mortgage backed securities also buy 10-year Treasury notes. The 10-year Treasury is impacted by many factors including:

- Overall economic conditions

- Financial Markets as a whole

- Inflation

- Interest rate moves by the Fed

Certainly, those four should point to an easing of interest rates in the mortgage market, but that’s not what happened. The short and long of it is that there’s now some uncertainty about how the economy will respond to tariffs and tax cuts after the election and so investors are demanding higher rates to compensate for more risk.

The only certainty we have right now is that things will change with a new administration though none of us know how that will impact the housing market or the broader economy. Promises and threats on the campaign trail may never materialize. We do know that we’ve been experiencing home price cooling as a result of the extended bout of higher interest rates. Houses are taking longer to sell. Buyers aren’t rushing to purchase and have choices.

Here's a thought if you’re thinking of selling. This stall in rate reductions may be with us for a while and then it may accelerate rapidly in one direction or another based on the new administration’s policy decisions. You may have some choices. The gradual price reductions are likely not to accelerate without some major shifts in fundamentals so if you don’t have to sell, maybe wait. This is the slowest time of year for real estate. The risk is that by Spring when the market heats up again, you may not see the price jumps you expected.

On the other hand, policy decisions could juice the market as an accelerant and prices could jump while rates drop. Here’s the thing. There’s no telling how this will go, but if things continue to go as expected, market prices will continue trending down as a result of interest rates going up. The American people voted for massive change. We just don’t know yet how that will impact housing. If I can tell you one thing, when things are going to change in a major way, the acceleration rate will speed up over time so be prepared.

As I stated above, the prices are softening a bit and you can see the price reductions are ticking up. Demand is softening ever so slightly with fewer multiple offers and the days on market (DOM) going up slightly. There's no panic implied here as this is a totally normal transition to our fall and winter months, but with a backdrop of change it could also be something you should be monitoring but only if you're looking to buy or sell. Each area of our Sacramento region is acting a bit differently too. With the significant downsizing at Intel in Folsom, that's having an impact on prices around there. There's also a lot of demographic sorting going on - people leaving for Idaho and people moving in from Texas. The market is still humming. So stay tuned!

Have a great weekend! Isn't it nice to have a spell of Autumn weather? I'm LOVING IT! So done with the long stretch of 100 degree days!!!!