Inside scoop on DEI in Real Estate

ABC 123 DEI

D stands for Disclosures. Disclosures are mandatory when selling a home in California.

Don’t want to be sued? Fill out your disclosures truthfully. California dictates some very strict requirements. Is your house haunted? Did someone die in the house in the past 3 years? Are there known issues that might not be apparent from a preliminary inspection? Does the house flood in the winter because a creek in back of the house flows over its banks? What repairs have been done to the property? Do windows leak and cause mold? If it’s not raining, this would be hard for an inspector to see.

Not all states have such requirements. Some follow caveat emptor or Buyer Beware. Buyers should carefully read over disclosures to see what the sellers have said about the house. It’s perfectly okay to ask questions or get clarification too. One small thing we have on our Transfer Disclosure Statement is an open question of how many garage door openers you have. You put 2, but you forget to leave them. Guess what? You need to provide them or buy a couple new ones for the buyers.

E stands for Early Occupancy. Don’t do it!

Let’s say that the buyer has an earlier close date on the home they are selling or they’ve just moved to our area from a different state. They have stuff and don’t want to put it in storage for a week or two so they ask, “Can we just store some of our stuff in your garage?”

There’s liability two ways here. If something in the buyer’s stuff ignites and burns your house down, your insurance may not cover it AND they certainly aren’t closing on your house! If on the other hand, it rains excessively and water floods into your garage and ruins their furniture, you are on the hook for paying for their loss. Or worse still, they move in to the house before closing and one of them loses their job and now the lender won’t lend them money. Good luck getting them out. In one case, a couple moved in and started demolition of the kitchen only to find out that they weren’t buying the house they just destroyed. There are more stories and so now most all brokerages and their respective attorneys will tell you, “Just say, ‘NO!’”

I stands for Insurance. The bad news is that it’s going to go up for everyone.

The fires in LA have burned through homes and insurance reserves as well. Those on standard insurance policies will be paying out and those on the FAIR plan will as well, but even with the Reinsurance all insurers can’t cover the losses to date and as I write this, I’m aware of another fire that just started in La Jolla in San Diego county. The way they recoup their losses is by charging all California homeowners more. So be forewarned.

There’s more to understand too. Cal Fire has updated their fire maps to include more suburban areas. I just discovered that parts of West Roseville are in a very high fire zone and homes recently built there were built on flat farmland! It’s a bit crazy.

Bottom line: fire doesn’t discriminate and neither does your insurance. I’ll report back when we get more information.

********************

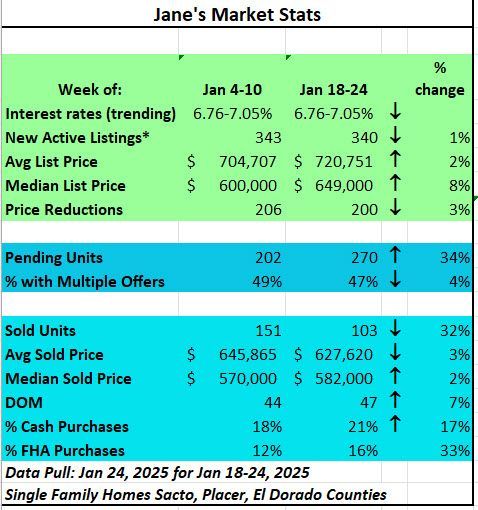

The real estate market is waking up quickly. Interest rates are pegged around 7% and few are expecting them to go down anytime soon. They might even go up like the price of eggs. I don't know...maybe there's a correlation there?! lol

Houses are staying on the market longer and so brave buyers have some choices.

Do you know someone who would like to get my blog about the real estate market? If so, forward them this email and they can subscribe HERE!

Jane Gray

Owner Broker

916.293.1734

JaneGrayRealEstate.com

Jane@JaneGrayRealEstate.com

CADRE#01973665