Is there a Crash Coming?

This is a top Google search when it comes to what people want to know about the real estate market. But, the question is, who's asking?

There's a primary cohort that asks this on regular basis. Millennials who want to be homeowners but think prices are too high. I wonder if it's more appropriate to say that they are "hoping" that that the market will crash.. Comments include, "I'm going to wait until the market crashes to buy" or "when the market crashes, it will be a better time to buy".

The fallacy of this belief is that a housing market crash includes a lot of other problems...stocks go down and people lose their jobs. So they want to wait for the rates and prices to be down. There's a mantra in the stock market that is just as applicable in the real estate market and that is "Don't try to time the market."

Why? Well, there's some reasons you've heard of before but you may have forgotten....

1) Let's assume you can wait.

You have 3.5% or more for a down payment and you're just going to wait until the market dumps again because, "heck, it's cyclical. It can't keep going up forever!" On the flip side, you're paying rent. Rent continues to climb with housing prices usually and we've seen this especially here in Sacramento. Let's just say that your aim is a starter home for the average price of $630,000. Great! You're hoping the market will crash and it will only cost you somewhere in the high $400k range. And if and when you can time this, it could be such a feather in your cap, but what if you get laid off when the economy is down - there's no buying a house when you don't have income.

2) You don't know how long you'll have to wait.

Here's why - we are at catastrophically LOW levels of housing for renters and buyers. There's just not enough housing stock which is one of the primary reasons that prices aren't succumbing to higher interest rates. Where are all the new houses coming from that are going to change the supply and demand balance to higher supply and lower demand that will cause prices to drop? Governments in California, nationally, and even internationally are trying this ADU thing and it's NOT enough. We are underwhelmed by the inventory that is coming online. Plus, there's a lot of potential sellers that are sitting on super low interest rates and they aren't wanting to sell.

3) When the market dumps - that means that homeowners are losing their homes!

People that lose their homes sometimes DESTROY their homes - they pour cement down the plumbing, rip up cabinets, molding, tear out appliances. They are so angry that they are losing their home, they just seek revenge. Is that a home you can afford to buy and fix?

4) When the market crashes, your competition is Wall Street and other investors with CASH and no contingencies!

They come in and scoop up lots of properties at low prices and they can fix things that are very expensive to fix for the average homebuying who's financing!

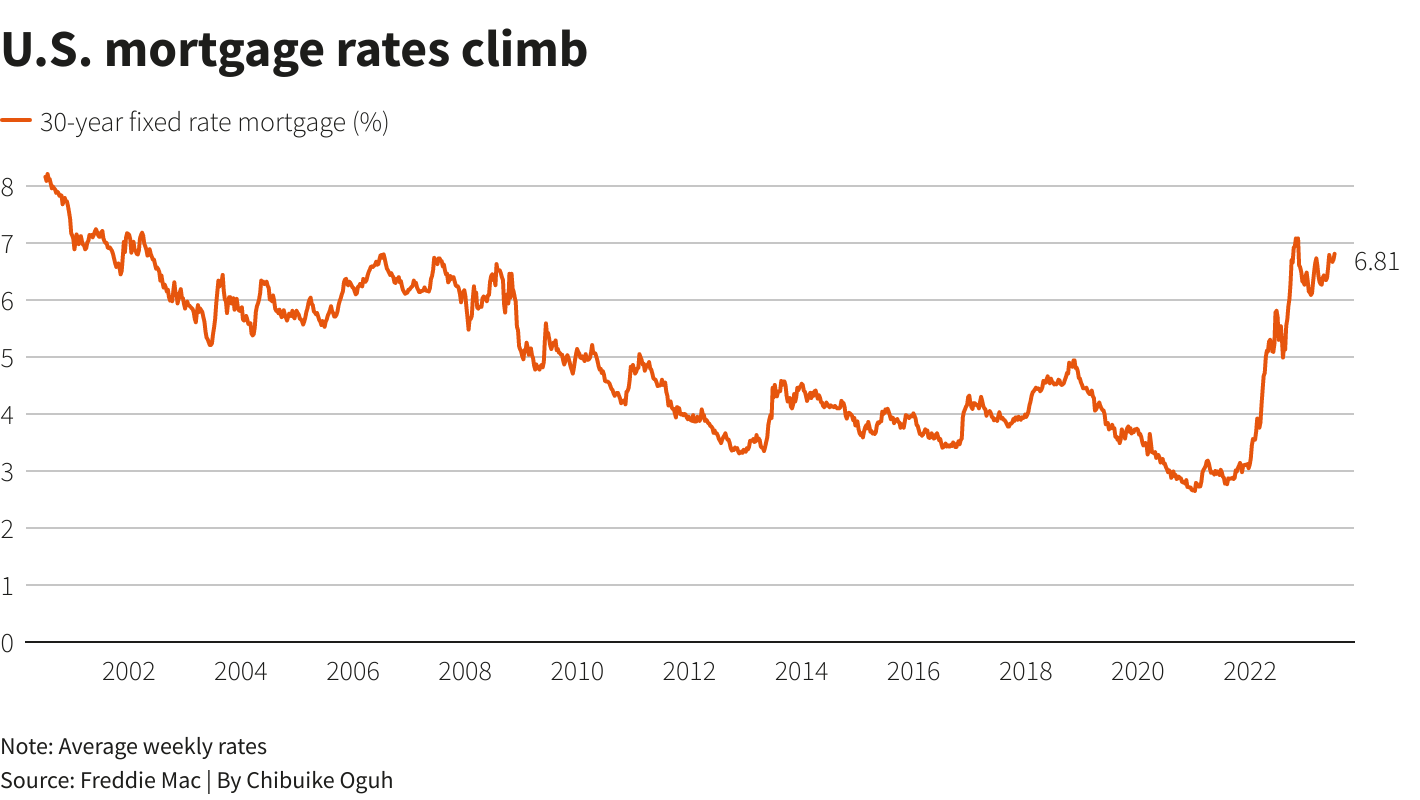

It's true that interest rates do cycle up and down. Here's a view of average 30-year fixed rate mortgage rates from 2000. The great news is that when interest rates go down, you can refinance too. So, consider that if you have the ability to buy now, it might be a good time to buy rather than waiting for that market crash that may not be the dream come true you're hoping for!

I'm very excited to announce that I've hung my broker's license at RE/MAX Gold in Roseville! RE/MAX is an international brand and they don't take new agents. Experience and Knowledge is the expectation. I love that! I'll now be known as a Broker Associate. Here's a fact sheet about the RE/MAX.

On Friday, I'll be back with the local market stats. I injured my back moving (should have known better) and it's been torture trying to sit at my desk.

Have a great week!

Jane