Market Update Feb 2024

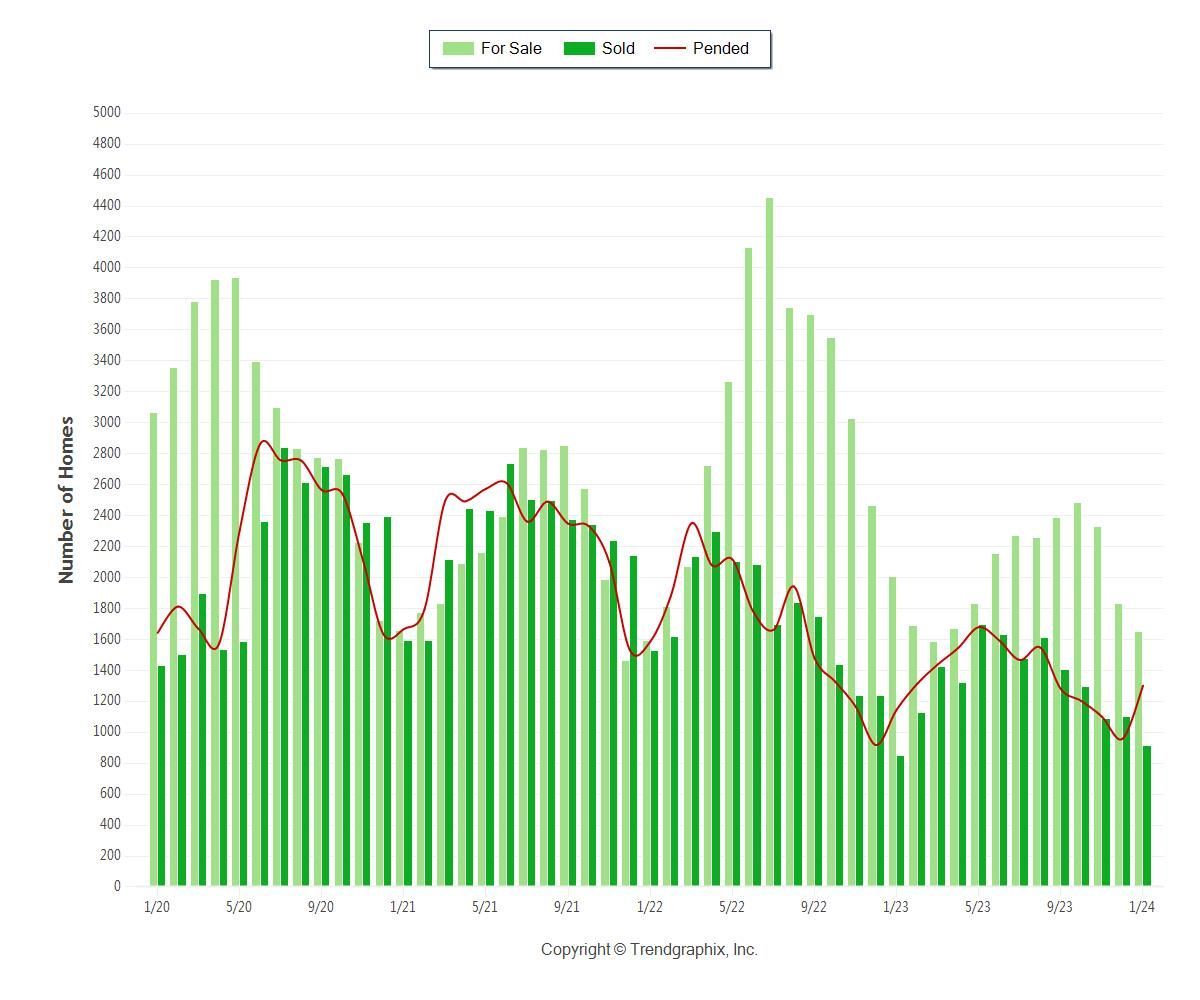

Are we back to normal? The above chart starts in January 2020 and we certainly thought at that time that it would be normal - early in the season, a bit slower, picking up and then moving into prime time. 2020 was anything but normal for both health and economic reasons.

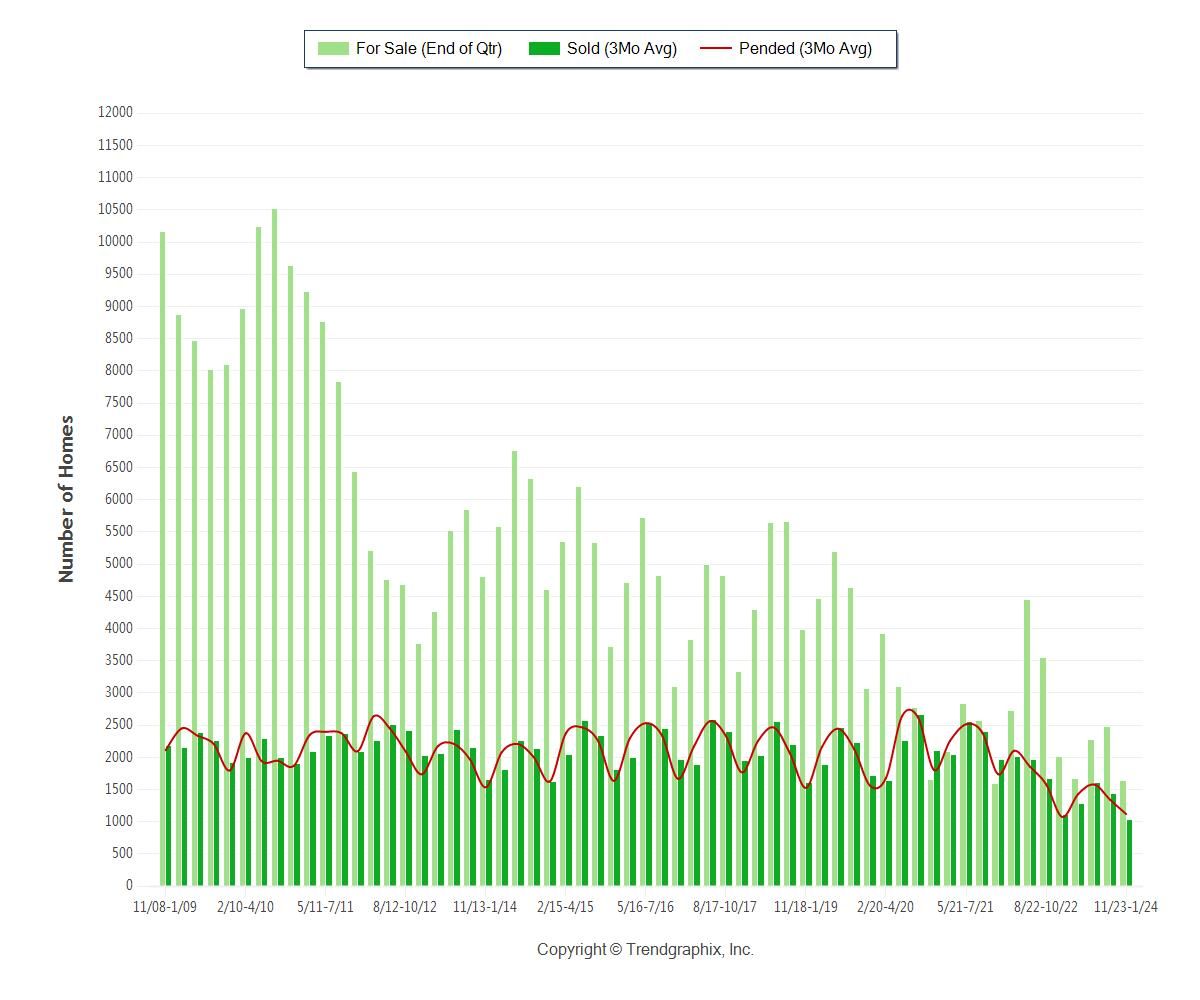

So what does "Normal" mean. Looking back, 2021 was an anomaly because of super low interest rates and then WHAM! The Fed started the raising interest rates at a rapid pace in March 2022 and here we are today feeling the rarified air of 7% interest rates. The thing to note is that it didn't stop the market. Let's take a look at a longer range. This chart shows us what happened when the housing market really crashed and it starts with Nov 2008. More houses (the light green) were on the market for years and up to 2020, the inventory was thinning out.

The chart illustrates that there were far more sellers than buyers until 2011 when it began moderating. The first period of roughly 2008-11 had more than 5 times as many sellers as buyers. By 2012, it dropped to around 3 times as many sellers as buyers and since 2020 we're trending just under two times as many sellers as buyers and while each has gone down in raw volume, the reason that prices aren't moderating should be coming into view. . There has been a sea change from 2008 to today.

The Fed has indicated that inflation is still too high and they won't be lowering rates in March as everyone had hoped. The buying activity while lower, hasn't been snuffed out though.. There's cash buyers and buyers who are counting on interest rates going down soon so they'd be able to refinance.

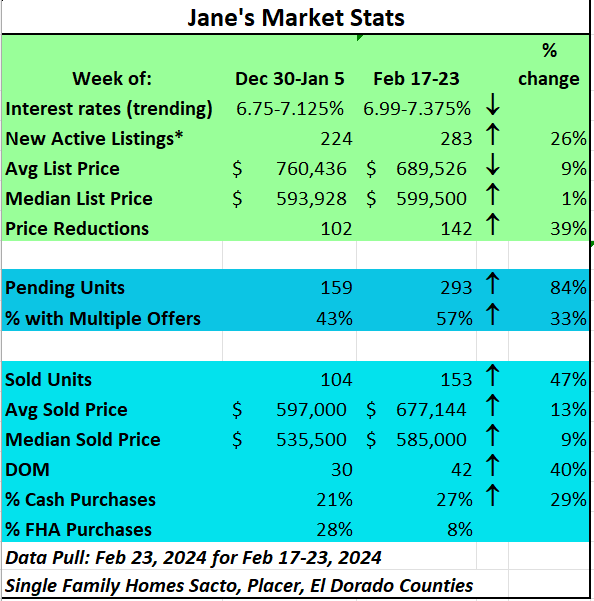

Here's a look at the weekly view and this is just comparing to the last time I ran this which was at the end of the year (still a weekly view). You'll note that cash purchases are now up to 27% while 1st time homebuyers represented by a proxy of FHA financing is pretty low. While there have been some swings - understand that the end of the year tends to be fairly quiet and March is typically when we see a jump in number of homes going on the market as we ramp up for the spring and summer selling season.

The important thing to keep in mind is that normal is a relative term. Sellers are in a great position because there's such a dearth of inventory but buyers too have some advantages in this market to negotiate. Opportunities to negotiate will be determined by desirability. If a home is very desirable, it will likely get multiple offers which you can see is reflected in the chart above - 57% of houses getting into contract this week had multiple offers. So what's a buyer to do? Don't go for picture perfect with all the bells and whistles. Look for a home in the area you would like to live that only needs some cosmetic upgrades - new counters in the kitchen, new flooring, new paint - this will give you an opportunity to negotiate for a lower price.

If you'd like to learn more, please reach out. This is a market that is ripe for negotiation. Don't get fooled by agents who just tell you to bring your "highest and best" because THAT is not negotiating.

I'm hoping that we can get through this weekend with NO RAIN. Yes, we need it, but we don't need to be swimming in the puddles.

Have a great weekend!

Jane