Is it the New Gold Rush?

SAVE MONEY! Right?

You're going to put your house on the market and you're pretty excited to hear all the news about lawsuits against the real estate industry. You're thinking - why in the world would I pay an agent representing the other side of the transaction, a commission? The thought experiment plays into dollar signs and you're jubilant especially since when you bought your house, you probably didn't pay a commission then either! No commission. Woohoo!

It's a totally legitimate thought and maybe you can save some money right? I mean how much does an agent do anyway? Especially a buyer's agent? The buyer probably found the house on Zillow and maybe they got their agent there too. So the buyer's agent writes up the offer and negotiates a deal that isn't as much money as you really wanted for the house. STRIKE ONE. Next, you're in contract and the buyers do inspections and they find that the house has an unpermitted addition with an exhaust vent which ties into the heater vent which is a fire hazard. The Buyer's Agent says it needs to be permitted or the client will walk. Your agent saves the deal by finding a licensed contractor that will remedy the fire hazard, but that's going to cost you an extra $4 grand. STRIKE TWO. As part of a pool inspection, the inspector finds there's a HUGE crack in the pool from settling and that it's losing an inordinate amount of water. The Buyer's Agent finds out that you (the seller) are the owners that put in the pool and because the inspector used to work for the pool company, knows that the company will fix the crack as part of their warranty but ONLY for the owners who put the pool in and she insists that the house not close until the pool company fixes OR puts it in writing to get it fixed. OMG! That's pushing out the close date and making you miss your deadlines on the house you're purchasing when you sell this one. STRIKE THREE.

But there's that lawsuit. I know I'd net more money if I don't have to pay as much commission...What could possibly go wrong?

Scenario #1 - The buyer doesn't have an agent. They are unrepresented and so there's no agent to pay. They don't get any inspections. The appraisal comes back lower than the sales price because no one did comps or knew that unpermitted additions may or may not be counted by an appraiser. The other option could have been that the lender would require the seller to remedy the issue - either tearing it down or opening the walls to get it permitted. The buyers don't have an agent but they are on Reddit and Google and they have a friend who bought a house in 2020 who got screwed so she's giving them advice. She urges them, "Walk" away from the deal and they do! Your agent is trying to save the deal, but she's talking to an unrepresented buyer who really doesn't even understand the contracts they've signed, but she got them to sign off on the inspection and appraisal contingencies. Are you going to get their Earnest Money Deposit? They decide to walk away and they probably will even get their earnest money back. Now you're back on the market at day 20 with some headwinds because interest rates went up again.... and because of higher rates, there could be fewer buyers which may cause your purchase to fall out because that seller on the house you're buying doesn't want to wait for you to find another buyer!

Scenario #2 - The unrepresented buyer above ends up closing, but they end up suing you, the seller. Why? We live in a litigious society - (think the lawsuit against National Association of Realtors). The listing agent has written the contract and the courts will pull the seller into the mix saying they took advantage of the buyer. Even though the listing agent only has a fiduciary responsibility to the seller, the buyer's perception is that they were taken advantage of. Oops you chose not to pay the buyer's agent - think of it like an insurance policy that you don't have in place. Attorneys aren't cheap.

Scenario #3 - The buyer wants a better deal and comes to your agent and says, "I don't want a buyer's agent. I want a better deal on buying the house and I know I can get that if the Seller doesn't have to pay for a buyer's agent. Your listing agent will still represent the seller and also represent me. I, as the buyer, get a lower priced house and the seller nets the same profit." Great deal, right? Let's explore. This is called dual agency. There's a legal conflict of interest and your risk has increased. Your agent is representing you as the seller and also representing the buyer. The buyer asks the one agent acting for both parties if they should get a roof inspection, but the listing agent cannot give advice either yes or no because it's a conflict of interest to give advice to either side. The buyer's perception is that the agent is not representing them - the buyer claims that they weren't loyal to them - can you say lawsuit?

Scenario #4 - Without offering a buyer's agent commission, you have reduced the incentive to get buyers into your house which ultimately may lead to lower offers or worse, no offers.

Is this the new gold rush? Or just fool's gold? It's a GREAT year to be an attorney!

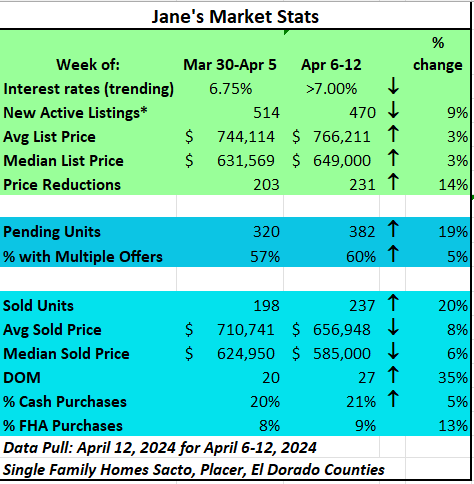

The market is heating up BUT be careful the whiplash of the FED's dangling, tantalizing promise of rate reductions that were supposed to be part and parcel for this year! Wow! They just went up above 7% yet again and now we aren't sure there will be the promised reductions! Even the large banks are saying that the higher rates are hurting their bottom lines.

Take a look at the number of multiple offers! Up again! 60% this week while new listings are down! This tells you there's just not enough inventory. Time to sell? Want an agent who gets results? Let's chat!

Enjoy the weekend! If you have any questions or comments, feel free to send me an email or reply to this post (it just goes to me).

Jane