Living Together

It's not always the Plan, but it can work: Multi-Gen Living

Multi-generational living is certainly not the norm. Though, roughly 5% of households may fit the definition of housing more than one adult generation under one roof.

It's become something of a necessity as interest rates have increased and suitable housing remains scarce for first time buyers (or renters) and those who have aged out of gardening and maintaining large homes.

You've heard it before...young adults are moving back in with their parents after college to make ends meet. So too, Baby Boomers may opt to share a home with one or both of their parents so that they can look after them has become common.

Approximately 20% of women over the age of 65 live in Multi-gen households compared to 15% men. Older Americans are more likely to live with another family member than a few decades ago.

Then there's young adults who are between the ages of 25-39 and they represent about 22% of their cohort who live in a multi-gen situation. Today's young adults are more likely to be living in their parents' home than previous generations especially for those with only a high school graduation.

About a quarter (24%) of Asians are living with an elderly parent and/or adult children, 26% of African Americans, 26% of Hispanics, and 13% Caucasians but this number is increasing. All of this is due to the increased cost of housing as well as the limited availability of housing that works. Experts estimate that there is a shortage of roughly 4-7 million homes that is affordable for both buyers and renters. New home builders' incentives are to build houses that make them the most money and those houses are large.

While some people look for a larger home (new or resale) to purchase to accommodate the increased size of the household, most try to make it work by adding on or modifying the existing home. Additional rooms give people space and privacy while also allowing for interconnectedness and the ability to help. Garage conversions, granny flats (ADUs), or add-ons all can work for an elderly parent to alleviate the need to navigate stairs. For a young adult, stairs to a new addition over the garage can provide a bit of privacy. Even shed conversions are a thing! Albeit with insulation, drywall, permitted electrical, plumbing, and a heating and cooling source. Detached garages may work with a mini split system (a heating an air conditioning as a standalone unit with ductwork). Creating additional space may not be wasted money either because if the young adult moves out, the space may be rented out for additional income!

Counties all over California have created departments that specialize in helping homeowners figure out what can be done. A common conversion I see is a 3rd garage bay that can be converted to an ADU (Accessory Dwelling Unit). I always look at homes that I will potentially list for sale for ideas that are fairly easy conversions. It makes for a robust selling point and it gives people ideas that maybe they don't need to sell. Sometimes it just takes a professional who can look at a home with fresh eyes. I see a lot of homes and a lot of different ways that people make their homes work for their lives no matter who's living under their roofs!

**********************

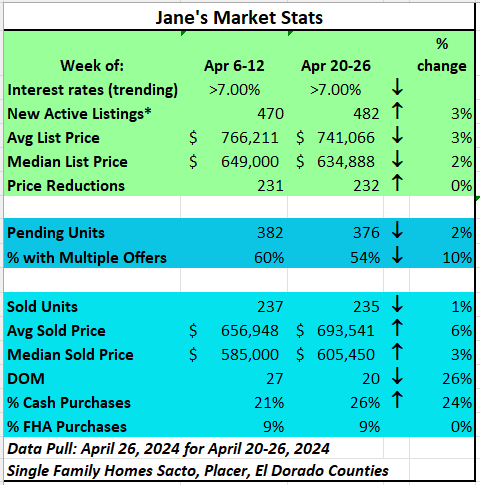

Things to note about the stats this week:

1. Cash purchases are up.

2. Days on market is down (ie. selling faster)

3. Multiple offers are down but still over 50%

4. The average sold price is up 6%

5. First time homebuyers relying on FHA loans are still struggling to gain a toehold on the Homeownership ladder of wealth.

6. Rates are still over 7%...and the Fed...well... Here's something to think about - there's talk now about a theme of Stagflation (occurred last in the 1970's) where inflation is stubbornly high, economic growth slows, and we start getting high unemployment. We're not there yet, but we could be. Are you living where you want to live? Factor the economic doldrums in for a 5 year window because it's a possibility. No crystal ball of course.

Have a great weekend!

Jane