Who Wins?

Interest rates had an impact on sales but that's not all...

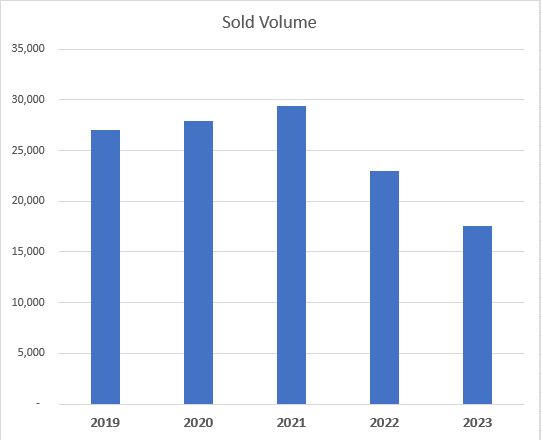

The effects began in March 2022 and the impact was ~10k fewer homes sold in 2023. This isn't news but it's interesting to see how buyer financing changed too as a result of interest rates lows and highs..

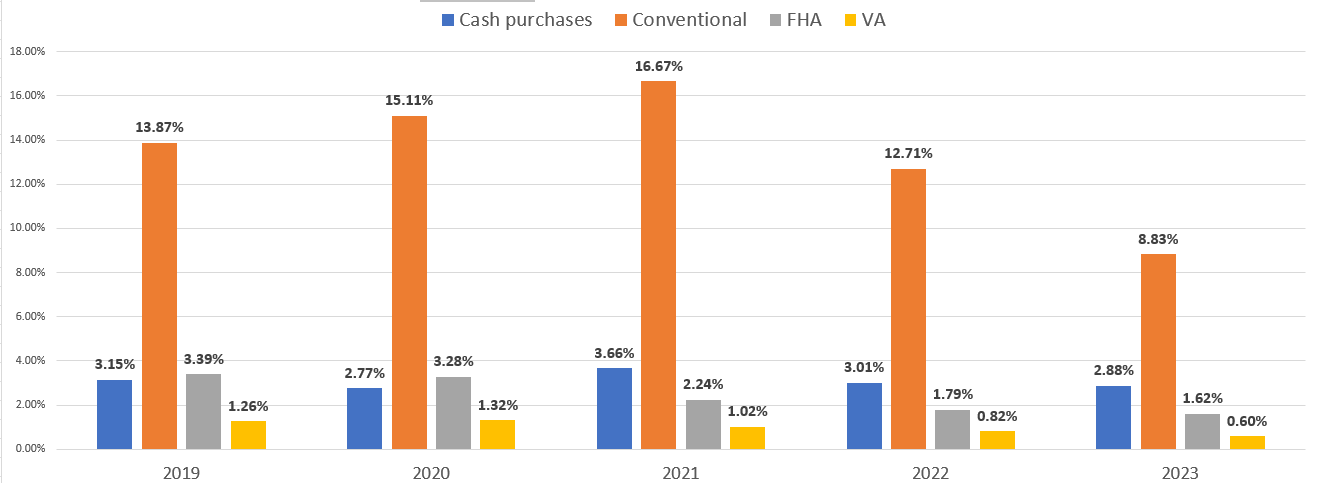

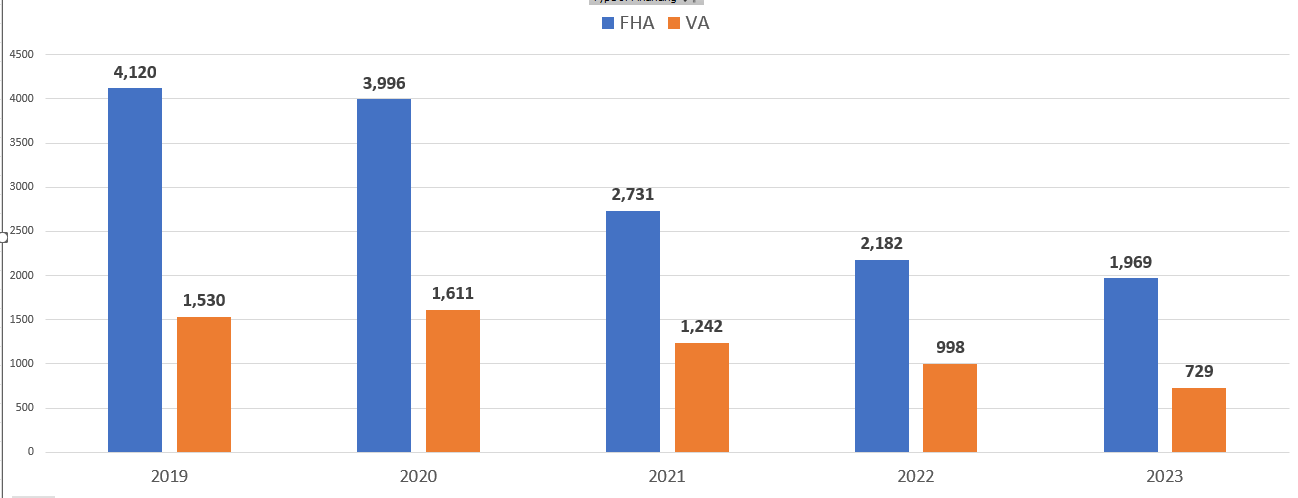

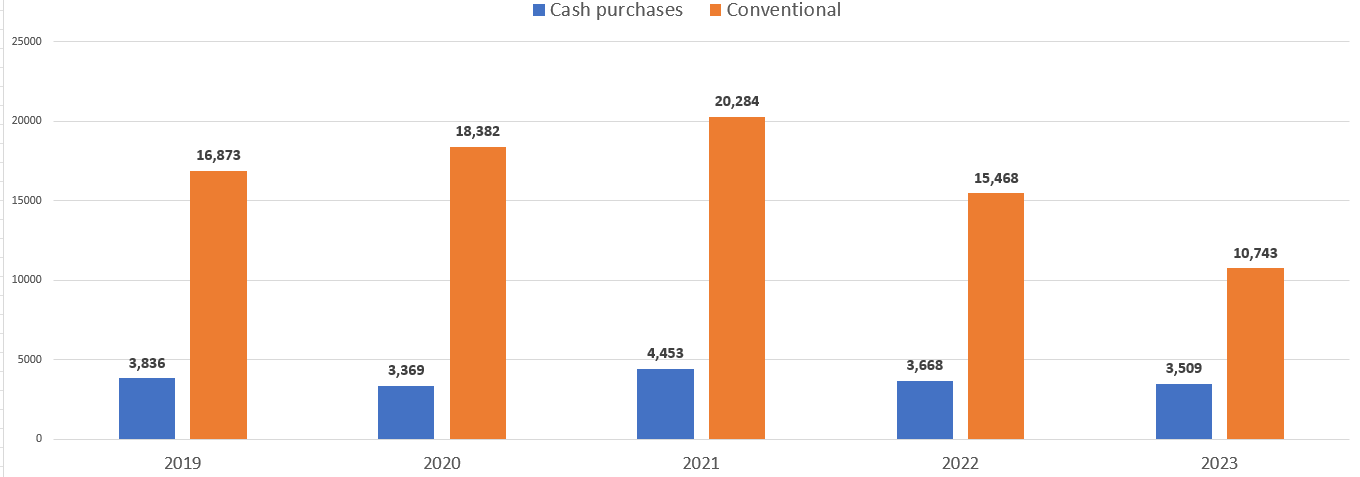

The main types of financing are conventional which requires better credit scores and often involves more money down. Cash which is a fairly strong force in our market - investors, people with large inheritances, people who have sold higher priced homes in the Bay Area and can then turn around and buy a house here without any loan, FHA financing is backed by the government and it generally supports first time home buyers, people that might not have the best credit scores, or not enough money to put down. VA financing which is another type of government financing for the military which can support zero down payments and poor credit though and it's another solid option for first time home buyer if they have served honorably in the military. But it's not just for first time home buyers or people with no money to put down or bad credit - there's other benefits to having a VA loan and generals with ample money and great credit use it. Still, in the graphs below, we are going to proxy the FHA and VA as first time homebuyers for a matter of illustration.

Here's an overview of the percentage to the total sales of each of the four main types of buyer financing.* Obviously, conventional represents the bulk of buyer financing. Cash, on the other hand, has remained a fairly consistent portion of overall sales in each of the past 5 years. What's changed though is mainly for first time homebuyers (FHA and VA).

Here's another graph with just FHA and VA pulled out to really see the drop off in sales by buyers using government financing who likely are first time homebuyers. You'll note that FHA even started to fall off in 2021 (whereas conventional financing went up in 2021. I think it's safe to say that due to super low interest rates and the competition to buy, that FHA and VA had a harder time competing.

Now compare that to Cash and Conventional. Conventional went up in 2021 while cash held its own.

So what's the takeaway from all of this, you may ask? Fair question. At the end of the day, there are still homes sold to first time homebuyers, but if you are one, now is a great time to get on top of your finances. Pay off debt. Save money so that when you are in a position to buy, you will have the best chance of qualifying for the best loans Saving for a down payment can take awhile - it can take years. Cleaning up your credit usually takes less time. But the two are very important to qualifying for the best rates. I find that many people first looking into buying a home haven't assessed their financial situation and many aren't living on a budget. I have a great budget app that I love and it helps with saving for those big purchases and getting debt paid off along with just managing day to day expenses and not overspending. All of this doesn't just happen. It's a discipline and a habit and there's no time like the start of a new year to master your financial situation. The app that I use is called You Need a Budget (available as an app for your phone and accessible via the web). It's a simple tool that mimics the envelope method, but because it's online, it's more powerful. Here's the link.

If you're just starting out and are interested in purchasing a home, reach out. Let's chat about what it takes.

*NOTE: The data I'm using captures single family homes, condos, townhomes in Sacramento, Placer, and El Dorado Counties. These four buyer financing options are not all of the ways a person can purchase a home - there's 1031 exchanges, Farm loans, assumable, auctions, etc. What I'm showing though is the primary ways. Oh, one last caveat, the data is only as good as the way each listing agent closed out their transactions.

Hope you have a great weekend!

Jane