Protect your Assets

Another unfortunate reminder...

We got a glimpse this past week of how quickly and how much can be destroyed by a wildfire. Aside from the very tragic loss of life, damage to homes was catastrophic. This is why we carry homeowner's insurance BUT, insurance companies are not all that keen on insuring the risk anymore. This will invariably lead to more insurance companies pulling out of California due to risk they don't want to insure.

About two weeks prior to the Lahaina fire, I attended a webinar for California Realtors by the California Insurance Commissioner, Ricardo Lara . Also represented was an organization for citizen policy holders called United Policyholders which formed after the 1991 Oakland Hills Firestorm. I'm passing on some important pieces of information that I learned. Feel free to pass this along to people you know. This is important information meant to help you with homeowner's insurance.

1. The California Fair Plan is the high risk pool by regular insurers in the state. It is meant to only be temporary coverage. The Commissioner is trying to get them to offer a discount for something called a Firewise designation. More information on what constitutes this recognition program can be found on the website ReadyforWildfire.org. Bottom line here is that communities must work together because a single house is no match for a sweeping conflagration.

2. The Insurance Commissioner got a concession from the insurance companies to share with you what your home's fire risk score is and provide you information on how to "harden" your home so you can bring down your score to possibly lower your insurance premium. Prior to this, insurance companies considered the scoring and risk as proprietary and would not share it with homeowners or businesses.

3. Amy Bach from United Policyholders uphelp.org said there are resources to reduce the homeowner's insurance premium call wrap resources. Find those resources here. She also stressed that you should find an agent that is "really" up-to-date on the fire insurance because it changes (especially with new wildfires like Maui). Both emphasized that just because you have had an insurance agent for years, doesn't mean they know the latest about wildfire risk.

4. Commissioner Lara said that you should do your homework too to find out on the California Insurance Commission website that the insurance company is solvent. He said that a lot of insurers are skirting the laws to drop coverage. He encouraged homeowners to call his office if they have issues with an insurer.

5. If you are in an HOA, make sure that they are working to get a Firewise designation.

**************************************

To Eddy and Jinny Ng on purchasing their new home in Morgan Creek in Roseville!

**************************************

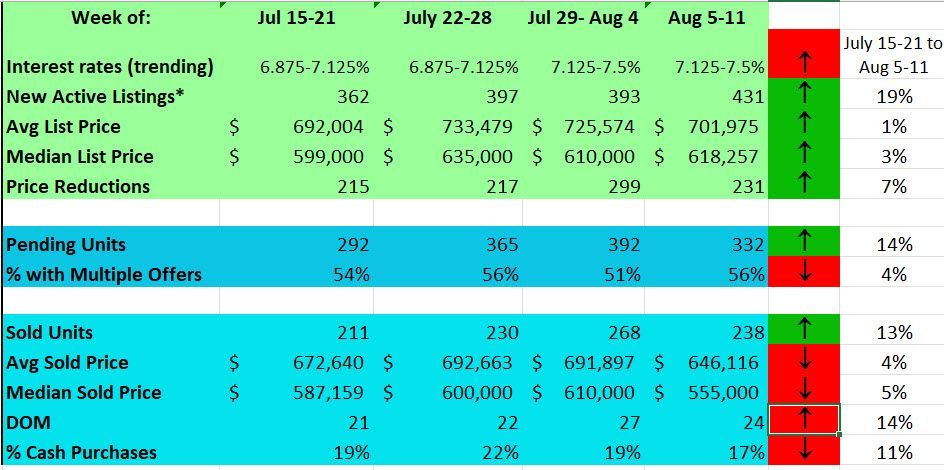

And even though I missed writing the blog for 3 weeks, I do have the stats! I just took a vacation from writing. The market is especially tight right now. There is an uptick of new listings but they are sitting longer. The ones going into contract are reflective of the interest rate hikes. The prices aren't overly optimistic, but there are still buyers! The market is moving but it's not like it was in 2021. You can see that there are still a fair number of cash buyers out there!

If you have a question or topic you'd like to see addressed, please send it my way either for a personal reply or a blog topic. Sometimes your question is helpful for others as well!

Enjoy the Week! I'll be back this Friday!

Jane