Issues of Renting in Retirement

Divorce can be hazardous to your Wealth

Of course, that's probably not news to anyone. In most cases, assets are split in half to support two households instead of one plus, there's the drain of paying attorneys to make the dissolution happen. For those that are divorced, there's a higher chance of running out of assets in retirement than for those who have never been divorced. Net financial assets in households that have never had to suffer through divorce is roughly 30% higher than in comparable households that have according to a study by the Center for Retirement Research (CRR). It spells out that divorce puts you at about a 5% greater risk of running out of money according to the study. Further, it concludes that divorce substantially increases the likelihood that their standard of living will decline after they retire. The analysis was based on projections of how much retirement income households can expect to receive at age 65 from Social Security, pensions, retirement savings, and home equity.

They study found that the share of risk of a lower retirement living standard is 7 percentage points higher for all households with a history of divorce than it is for similar households with no prior divorce. Interestingly, the subgroups analyzed face the prospect of more risk for any married couple where at least one previously divorced spouse and for divorced men who have not remarried. The oddity in the data is women who didn't remarry. They were unaffected, even though they often were the ones to assume the responsibility and costs of being the children's primary caregivers. Research suggest that these costs may be offset because divorced women often retain ownership of the family home in a divorce settlement and home equity is a retirement resource. Home equity continues to be a greater source of wealth for any homeowner as time goes on because of increased equity caused by price inflation and paying down a mortgage. Tapping into equity can be a major difference for women (and men) to increase financial security.

On the other hand, I watched as many retired single divorced women who were renters scrambled to find affordable places to live as rents began to climb. With dwindling options, many single retirees were forced into moving in with family or moving away from the area. When home prices were going up, many landlords used the opportunity to cash in by raising rental rates that had long slumbered or by selling and reaping a nice return on investment. No one expected rents in the Sacramento area to increase so dramatically. Prices of homes aren't expected to fall any time in the near future with the lack of inventory. The prices have moderated in some cases and there's not as much competition. Whether you are divorced, thinking about getting a divorce, or will never divorce, owning your own home is a solid hedge against inflation. If you don't own, maybe you might consider what financial security owning a home may provide?

********************************

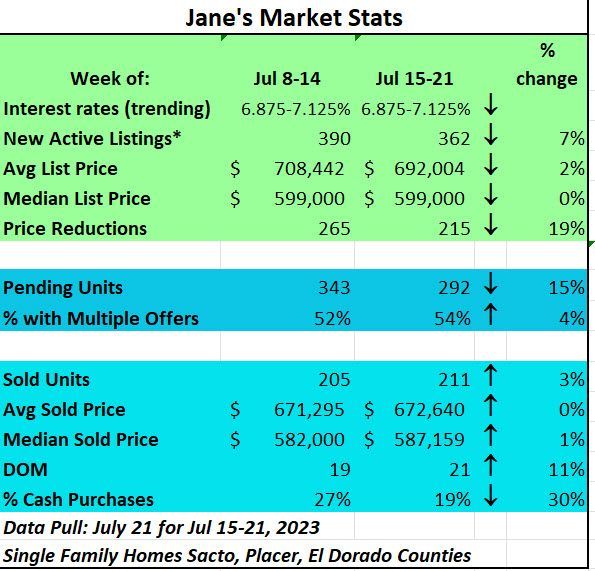

The market right now reflects vacation time. The market has slowed even more from where we were a few weeks ago. We expect to see it pick back up again as people return from their summer vacations.

Hope you have a great weekend! Stay Cool!

Jane