Have we been here before?

Anyone familiar with this phrase, "Past performance is no guarantee of future results"?

It's applicable to where we're at today with the housing market. The jobs report just came out today and despite crazy rate hikes and the Fed attempting to cool the economy, the American economy seems intent on blowing past all projections. 336,000 jobs added in September which was twice what was expected. You know what that means? It means there may be more Fed rate hikes in the future! This is just crazy! Here's why. Interest rates have shot up from 2 and 3% to over 7% heading to 8%++ in a little over a year and a half.

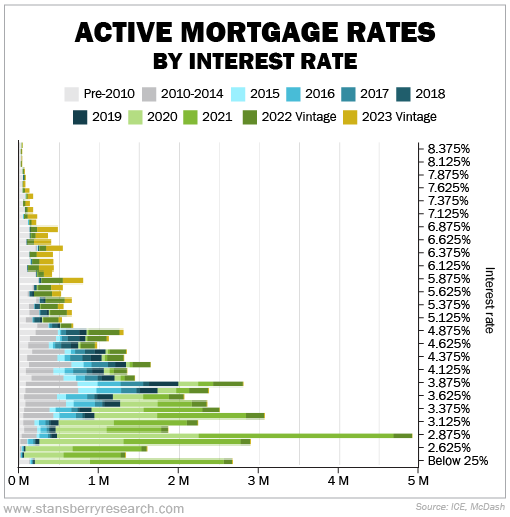

I read a great article this morning from Stansberry Research. Thanks Robert for sending!

The market completely broke apart for 1st time homebuyers. Buying a first home is out of reach for many with rates starting at 7.75%. It means that they can't afford much, much less than they could have a couple years ago when mortgage rates were 3% or less! And this might be okay if prices came down, but they're not! People with low interest rates are not wanting to sell which has created a dearth of inventory and that folks, is why prices remain stubbornly high! Everyone expected a market crash with interest rates the same - Didn't happen that way!

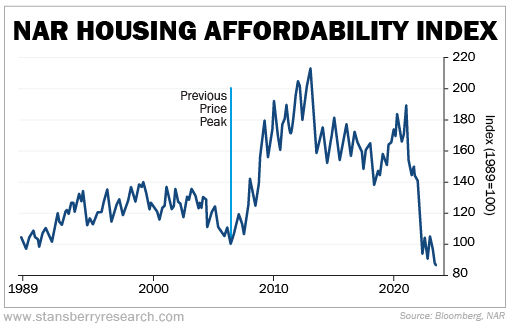

Houses now are more unaffordable than they've been since 1989. Look at the graph from National Association of Realtors.

Of course, the problem isn't limited to first time homebuyers. Anyone who wants to sell and buy another house with financing, has to consider the interest cost on the next loan. Many buyers with considerable equity from a home they are selling are putting a larger down payment to reduce the extra burden from the higher interest rates.

It hasn't stopped the market though. Because of the stubbornly low inventory with the rates higher than they've been in a while, Stansberry correctly calls out that they cancel each other out.

Another telling graph they put out, shows what active mortgage interest rates are. As you can see, there's a overwhelming percentage of homeowners sitting on lower rates since 2018.

Andy Walden at Intercontinental Exchange thinks one of three things needs to happen in order to bring affordability back to pre-pandemic levels:

1. US incomes would need to spike 55%

2. US home prices would need to fall by 35%

3. Mortgage rates would need to drop by 4 percentage points - how's a 4% mortgage sound after seeing 7.75%?

He goes on to say that the most realistic scenario is a combo of the three. Home prices fall 10-12% over the next couple years, incomes increase about 8-12% over the next 2-3 years (averaging 4% per year), and mortgage rates fall about 150-200 basis points over the next two years as the Fed cuts rates (that would be mortgage rates around 5.75 - 6.25%).

No one is forecasting a crash. Of course this is NATIONAL data and our market does react a little differently in some cases because there's still a migration from the SF Bay Area. Sellers need to think about the fact that home prices are projected to fall in the next couple years. Of course, anything can happen! We've heard projections of recessions, crashes, interest rate reductions...It's likely that rates will eventually go down, but will US incomes go up that much? Will inventory stay stingy?

We just haven't been down this path before. Well, not in my lifetime. Past recessions have killed jobs, the housing market, and stocks. This performance gives us fresh insights to a new reality. One I'm sure the econo-heads will be studying for years to come. It's not Stagflation. It's not a Recession. So what is it? I think the housing market is ailing with LONG Covid.

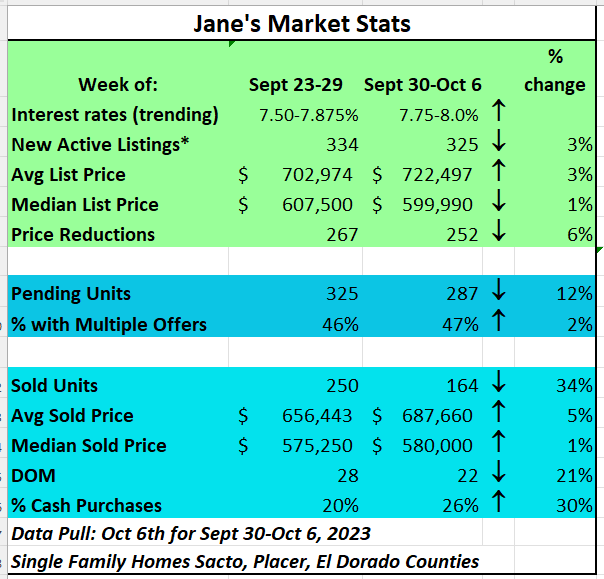

Let's turn our attention to what's happening in OUR market...

Cash purchases are still trending at around one fourth of all weekly sales. Days on market dropped this week, but the average sold price trended up by 5%. If you're thinking of selling, let's chat. Houses are still selling!

FYI - Just want to let my readers know that I now have my California Notary Commission and can do a mobile notary signing in the Sacramento area for you. Obviously, you could go to a UPS store and get documents signed yourself. My services are mainly for those who aren't mobile for whatever reason (hospital, elderly, etc.). Let me know!

Hope you have a great weekend!

Jane