Choke Point?

Choke Point or Flat Line...

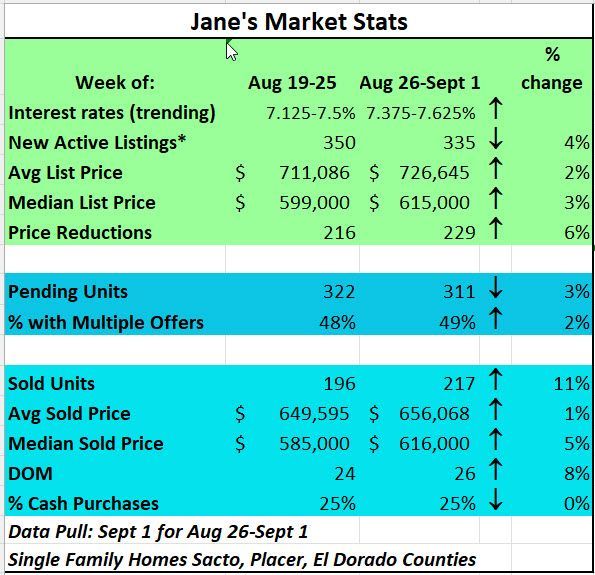

The current state of the housing market reflects pressure. Interest rate hikes, compliments of the Fed, weigh heavily on the fluidity of the market. Raw numbers don't tell the whole story either though those numbers do foretell a potential train wreck waiting to happen. There were 48% less homes on the market in July 2023 than in July 22. There were 15% fewer homes sold in July 2023 than in July 2022 and we haven't even seen August 2023 numbers yet. Unemployment numbers just came out and are now up to 3.8%. Don't we wish that's where interest rates had fallen?!

There are a number of loan modifications starting to happen for people who may have already lost their jobs. Credit card interest has shot up. The next shoe to drop is when student loan payments restart next month. Granted, there's supposedly a years-long on ramp to help borrowers, but the reality is that many young people filled the void of no student loan payments with car loans or credit card debt. The Fed may want to reach their arbitrary 2% inflation number with continued rate hikes, but it's going to come at a very high cost to the economy. People are still feeling the pain at the grocery store and at the gas pump. Housing prices haven't softened that much, but they could if more cracks show if the Consumer Confidence.Index is the canary in the coalmine. After 2 months of increasing consumer confidence, the Consumer Confidence Survey reflected that consumer confident fell in August. Hard data shows that employment gains have slowed, wage growth is less generous than a year ago, and the number of weeks of unemployment is ticking upward. The survey shows that a greater percentage of consumer sentiment of an impending recession is "somewhat" or "very likely" to happen. Consumers plans for purchases were a mixed bag with a six-month rolling average showing that consumers were still planning to buy autos and appliances, but decidedly shying away from plans to buy homes.

While pundits seem to be pulling back from the edge of predicting a recession, it's the feet on the street who tend to be feeling a different reality. High interest rates aren't benefitting savers in any meaningful way - 5% for a high yield savings account isn't significant unless you park a substantial amount of money there, but 7.65% interest rate for a home can be a serious burden. For the average priced home from this week ($650k) with a 20% down payment which most first time homebuyers don't have, the monthly payment of just principle and interest is $3,689 per month. For those with 3% down, it jumps to $4,470 per month! That's a considerable chunk of change for young families. I read recently that a large percentage of first time homebuyers are getting down payments from family - inheritance and gifts from a family member, And for those who don't have family help, about 67% of millennials who want to buy a home have exactly $0 saved for a down payment.

The 2020-2022 lower interest rates enabled many millennials to start their home ownership journey even with the price of homes trending higher, but unfortunately for the ones that waited,these first-time homebuyers are, by and large, priced out because of interest rates right now. Not to mention anyone who wants to downsize or upsize when they're sitting on a sub 3% interest rate.

This is not to say that the housing market has stopped. Chatter from agents reveals that life events tend to be the drivers in the market right now - deaths, divorces, inheritance, job relocation...The market is still moving as it always does, but it's decidedly slower and whether this is a momentary choke point or a flat line remains to be seen. Many agents in the Sacramento are are seeing their business fall by 2/3 from a normal year. It may not be all doom and gloom because if the Fed acts faster to falling sentiment than it did to the increased rate of inflation, we may see lower interest rates and minimal damage to the economy.

Here's my perspective - I do NOT have a crystal ball and so what I'm going to say is strictly my educated opinion. If you're looking to sell, the market is shifting down. This is not going to improve in the next year unless interest rates take a dive which will create fresh demand. Yes, there's still a shortage of houses but there's also starting to be an increased shortage of buyers which makes demand drop and we're seeing that prices are responding with softening. The pressure on the market isn't abating. If you've thought of selling, maybe it's time to do it? Have you ever been caught with less than you wanted because you waited? I have. It's painful. Most people spend a lot of time second guessing their decisions.

Calling out that nearly half of the houses sold this week and last had multiple offers and it was almost all in the low end of the price range! A quarter of all sales were cash. The new average sold price for the Sacramento area is now around $650k.

Happy Labor Day weekend! Enjoy that extra day off!

Jane