Pause and Effect

The world is still spinning. The sun is still coming up in the East and setting in the West. Granted, there’s a lot happening and it’s got people’s attention.

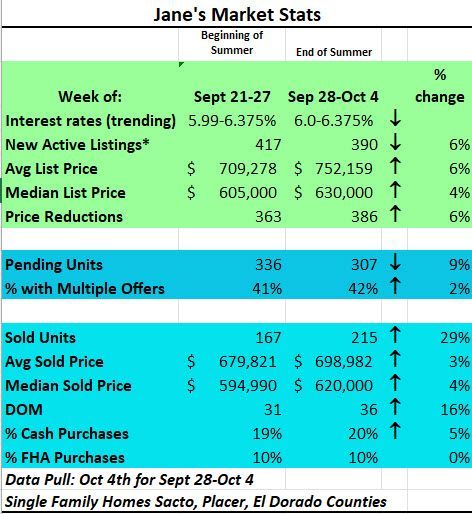

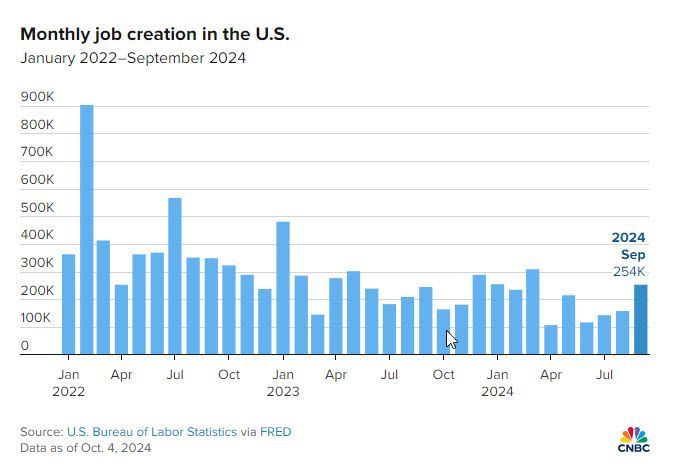

The real estate market has slowed. Price reductions have increased by 6% since last week and pending units went down meaning buyers are taking a pause. Interest rates ticked up a bit, but the Jobs Report came out today and the trajectory of solid hiring is picking back up - maybe the soft landing that was predicted by the Fed? It remains to be seen but so far it's looking much better.

The lagging indicator impacted home sales because with the foot off the gas (higher interest rates paused some buying and selling), the real estate car slowed. Let’s say you are motivated to sell and the timing is now. What is your best strategy? What do you do to prevent a full stop to your transaction?

It starts with consulting a professional who isn’t going to promise you a halo of sunshine to get a listing. The reality on the street is that buyers are very picky and want what they want. In fact, there’s been an uptick of contract cancellations. It’s not enough to get into contract. You have to stay there, but how? Know or be schooled. Do the work. Be nimble.

Know the market and the winds of change

Is it going up or down? Markets can shift and change rapidly and right now we’re getting a whiff of change with a slowing in the price increases. Is the slowness going to accelerate or will it suddenly tilt into a full-blown multiple offer situation again with successive interest rate changes? Right now, the data signals that the buyers aren’t in a hurry. That lack of motivation can drive us into a buyer’s market which favors buyers when prices fall. The opposite is true too. When we’re in a seller’s market, the sellers have the upper hand and with it the prices continue their climb. With the latest trend in the jobs report, the Fed may continue to push interest rates down and that will put the foot on the gas.

Do the Homework and be more in control

Selling a home is a monumental endeavor from cleaning to packing and determining what’s next. There’s also the preparation to listing your home. In the Bay Area, it’s been traditional to have all disclosures done up front along with all inspections – yes, paid for by the Seller. Here’s a little secret. If you do a home and pest inspection and have the reports, you know what the buyer is going to find and can address things with fixes and/or a price adjustment. The cost of doing the basic home and pest inspection is usually less than $1000 and the return on that investment can be huge. A Seller that does inspections before a home hits the market retains more control over the outcome of an escrow and limits a major escape hatch for the buyer. If the buyer’s inspections turn up major repairs like a needed roof replacement and you don’t want to pony up the money, there’s a chance it will fall out of escrow.

In a falling price market, a seller having to go back on the market, may have to price it even less than when they went into contract OR the seller can pay for reports ahead of time and price the house less accounting for a portion of a roof replacement. It also gives the seller leverage to ask the buyer to forego the inspection contingency altogether or shorten it to single digit days.

Another bit of homework that tends to pay off is staging. People are drawn more to the furniture and the vision of living there in that staged home than they are to empty rooms or furniture that might not be as modern as they'd like. Staging even has star power to amp up how a house shows online. A recent seller had a beautiful home but she didn’t want to stage, but she did and the results far exceeded the sales price expectations! Try almost $50k more than the comps with multiple offers.

Pricing realistically rather than aspirationally

When a market is slow or sluggish, it can pay to be ahead of the curve. Aggressive pricing, offering concessions, and pricing a home where the comps are or below means that the home will sell quicker. Homes priced higher than the comps may satisfy the urge of a seller to get the highest price possible but the likelihood of a quick sale are low and the opposite pivot is likely to happen where demand is low with no offers and days on market goes up and in a slowing market, the seller is chasing the market down.

It’s very natural to want to price a home higher thinking that pricing works like an item at a store – in other words, a set price. The truth is that homes aren’t that simple – location, features, and homogeneity with other homes introduce a veritable range. Buyers, lenders, and the availability of cash can greatly change the calculus too. Buyers value a home based on what they’ve seen and what they want. If a buyer is financing, the appraisal required by a lender values the home on objective and factual data. Those two factors can limit a buyer from overpaying unless they have some or all cash. The example above where the staged home sold for nearly $50k more was a factor of cash. The initial offer came in at asking price and with the additional two other higher offers, the initial offeror came back with a winning offer that far exceeded the other two.

So what?

If you aren’t selling right now, it’s a non-issue. If you are wanting or needing to sell, the strategy you use is important because this isn’t 2021. Keep in mind that being realistic about what the market is doing generally but also in your neighborhood is important, doing your homework (e.g. inspections) or pre-work, and pricing it correctly can reap you good results. If you have questions about how to go about that, let’s chat!