A Glance Back

Jane Gray • December 27, 2023

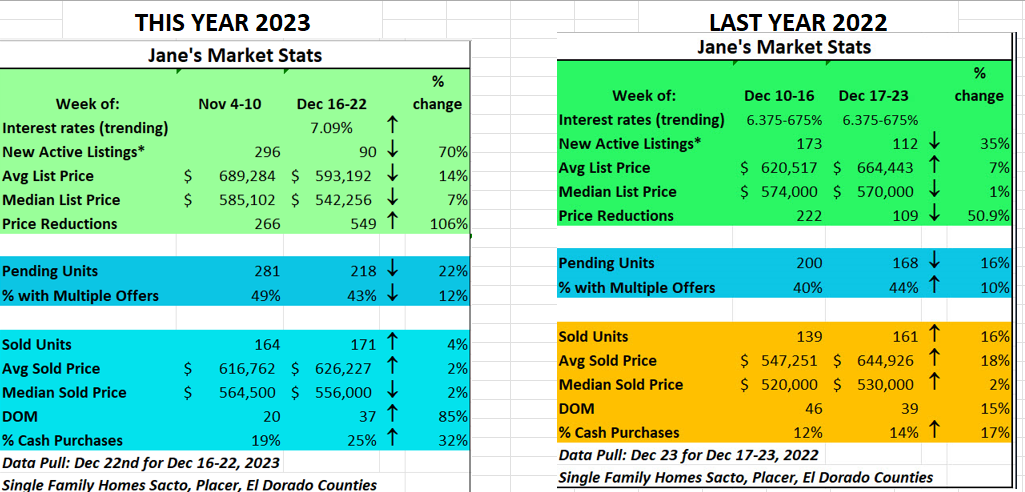

Sometimes the past informs the future... I thought it might be insightful to look at the stats from last year at this time and compare them to today's stats.

Besides the change in color palette, the points I'd like to showcase are that the interest rates definitely have an impact on prices. Last year at this time, the interest rates were 6.375-6.75% and now they are over 7%. Prices have fallen in response to a reduced buyer demand - they certainly haven't fallen off a cliff, but there's an impact when buyers aren't as motivated by the higher interest rates. You'll note there were more cash purchases this year (25%) than last (14%). Multiple offers have remained pretty consistent in the 40% range. Many more price reductions though.

The Fed has indicated that it may lower interest rates three times next year because they feel that they've helped the economy with a soft landing and gotten inflation back in check. So, should you wait to buy? Let's go back even further to 2020 and 2021 when interest rates could be had for 2-4% (I'm not saying that's ever going to happen again, but...) What happened to prices then? Yep, stratospheric rise inversely related to the rock drop in rates. So you tell me - is it better to buy when prices are perhaps softer now and refinance when rates improve or buy at higher prices when rates cause prices to go up? You'll note of course, that there's not any big change to the housing shortage so we are only going to be dealing with interest rates as a driving factor and as more buyers are prompted to get off the sidelines and back in the market, the prices will likely go up again. The other interesting thing is that prices haven't cratered even as interest rates have reached dizzingly new heights in decades. Food for thought.

Speaking of Food...Let's turn our attention now to the holiday season. I wish all of you a wonderful Christmas and a very Happy Holiday Season! Sorry I was absent for a bit. I sold a house back in the DC area and had to fly back multiple times and then also went to see my granddaughter in San Diego, and with all that traveling I'm now nursing a cold! Arrrh! I'm on the mend and hope you don't catch it!

SAFE TRAVELS if you're traveling. Enjoy and be safe! Wishing you the very best this season!!!!!

Jane

This is it! The Spring Market. How's it going? Last year, the consensus was that inflation was ever so close to the 2% target, unemployment was hovering around 3.9% which was a good sign, though interest rates were hovering around 7%. The belief from economists and the Fed was that soon (they predicted 2025) interest rates would start coming down. Well, they have come down marginally. With the best credit, it's below 7% and that is a GREAT thing compared to last year. I've done a comparison below of the end of the month in March compared to April for this year and then compared that to one of the last weeks in April last year. It's similar with some exceptions. Let's talk about what it says and what economists are saying as well. the first two data columns are basically month over month for this year. The last data column is this time last year. Notable: Interest rates are down slightly from last year The number of new listings are up slightly this year from last year at this time. The average list price is up ($748k) slightly, but the number of price reductions has nearly doubled. Pending sales is down as are multiple offers. The number of sold units is down slightly as are the average and median sold prices. Lastly, Cash purchases are down a bit too. The percentage of units that are being sold "vacant" is high. I wasn't tracking this metric last year, but it's notable how many homes are vacant as I take buyers to preview homes for sale. The market, obviously, is impacted by many other things going on. I occasionally check in with a Reddit thread for layoffs mostly because the tech industry does influence our market and there's been a notable uptick in layoffs which are not necessarily related to tech or in our area - though Intel is going through another round of a significant reductions. I've had clients who've been impacted by job cuts and they're saying the time to get rehired is growing. Obviously, no one has a crystal ball on what may happen, but there are still buyers wanting to purchase a home so there are sales! If you're looking to sell or buy, reach out. There's more to learn.

Anyone remember the last meltdown? There's so much happening that it's tiring. Did you see the Big Short? The last recession was the big banks playing the mortgage market like a slot machine and then someone shorted it like the game of Musical Chairs and the only ones without a chair were the ones that lost their houses. Small loss for Wall Street - it only took out a few firms. The Trump administration is looking to privatize Freddie Mac and Fannie Mae again. The reason I bring this up is that Freddie Mac and Fannie Mae were put into government conservatorship as a result of the 2007 mortgage meltdown to allow the mortgage market to get back on its feet. Those institutions buy up mortgages so that money can continue to be lent to new home buyers and builders and it works pretty good until it doesn't... Stand by. Maybe you can invest in the stock before the next big short? Next subject - How's the market? Glad you asked! There's the normal Spring market and then there's a lot of other factors that are playing into what's happening. I have been out showing homes in Roseville and Rocklin to buyers in the $600k range and 95% of them were vacant. That's a bit unusual. Some of the reasons were that the sellers had to move for jobs (the job market in many sectors is sluggish), they are moving because companies are forcing people back to the office 5 days a week. Honestly, I think this lasted longer than I expected. And yes, that's job related too. Some are packing up and leaving California. Insurance is going up for everyone in California. PG&E wants to raise rates so that they can pay their shareholders more! Interest rates are still stubbornly high and the Fed may reduce interest rates but it's likely not going to cause mortgage rates to fall. China and Japan are major holders of 10 year Treasuries which typically move in unison with mortgage rates and those countries are expecting higher yields as a result of the fast changing economic landscape here. So will mortgage rates go down? Get out your crystal ball. They've been fairly stuck around 7% for a while now. I hope they come down. Price reductions are inching up. The market is starting to cool off a bit in some ways. There's still an influx of people coming from the Bay Area and you can see there's still a notable percentage of multiple offers - nearly half of all homes that went pending this week were facing multiple offers. The inventory is still a bit low. If you are thinking of buying and or selling, reach out. I'd love to help you understand the market specific to your situation - It's NOT all the same. Different price ranges and different locations are experiencing very different market demand.

Listen up so this doesn't cost you (too much) I just completed ongoing training to get my certification to handle probate and I'm going to lay out some basics that you might want to know to save you or your loved ones money. The truth is, "We don't get out of here alive" (credit to Jim Morrison, Paul Newman, et al) Do you have a living trust? Do your parents? You/they should if you own real property or anything of value. A revocable trust is a legal document that allows the creator (grantor) to transfer ownership of their assets to a trust while still retaining full control over them during their lifetime, meaning they can change the terms of the trust or revoke it entirely at any time; it's often used to avoid probate court and distribute assets to beneficiaries more privately after death. Sadly, it does cost money. Prices range from a legal specialist who can do one for a few hundred dollars to a Trust Attorney who likely will charge you a few thousand. Here's why it matters though. Generally speaking, a trust can help prevent a chunk of change being removed from the estate when you pass away. Here's a hypothetical:

ABC 123 DEI D stands for Disclosures . Disclosures are mandatory when selling a home in California. Don’t want to be sued? Fill out your disclosures truthfully. California dictates some very strict requirements. Is your house haunted? Did someone die in the house in the past 3 years? Are there known issues that might not be apparent from a preliminary inspection? Does the house flood in the winter because a creek in back of the house flows over its banks? What repairs have been done to the property? Do windows leak and cause mold? If it’s not raining, this would be hard for an inspector to see. Not all states have such requirements. Some follow caveat emptor or Buyer Beware. Buyers should carefully read over disclosures to see what the sellers have said about the house. It’s perfectly okay to ask questions or get clarification too. One small thing we have on our Transfer Disclosure Statement is an open question of how many garage door openers you have. You put 2, but you forget to leave them. Guess what? You need to provide them or buy a couple new ones for the buyers. E stands for Early Occupancy . Don’t do it! Let’s say that the buyer has an earlier close date on the home they are selling or they’ve just moved to our area from a different state. They have stuff and don’t want to put it in storage for a week or two so they ask, “Can we just store some of our stuff in your garage?” There’s liability two ways here. If something in the buyer’s stuff ignites and burns your house down, your insurance may not cover it AND they certainly aren’t closing on your house! If on the other hand, it rains excessively and water floods into your garage and ruins their furniture, you are on the hook for paying for their loss. Or worse still, they move in to the house before closing and one of them loses their job and now the lender won’t lend them money. Good luck getting them out. In one case, a couple moved in and started demolition of the kitchen only to find out that they weren’t buying the house they just destroyed. There are more stories and so now most all brokerages and their respective attorneys will tell you, “Just say, ‘NO!’” I stands for Insurance . The bad news is that it’s going to go up for everyone. The fires in LA have burned through homes and insurance reserves as well. Those on standard insurance policies will be paying out and those on the FAIR plan will as well, but even with the Reinsurance all insurers can’t cover the losses to date and as I write this, I’m aware of another fire that just started in La Jolla in San Diego county. The way they recoup their losses is by charging all California homeowners more. So be forewarned. There’s more to understand too. Cal Fire has updated their fire maps to include more suburban areas. I just discovered that parts of West Roseville are in a very high fire zone and homes recently built there were built on flat farmland! It’s a bit crazy. Bottom line: fire doesn’t discriminate and neither does your insurance. I’ll report back when we get more information. ******************** The real estate market is waking up quickly. Interest rates are pegged around 7% and few are expecting them to go down anytime soon. They might even go up like the price of eggs. I don't know...maybe there's a correlation there?! lol Houses are staying on the market longer and so brave buyers have some choices.

Happy New Year! Let's all be thankful that our year in Northern California started wet. This wasn't the way to ring in a new year. The fires devastating the Los Angeles area may have a serious knock out punch for homeowners whose fire insurance was cancelled late last year. Not only did they lose their home along with memories and all their personal belongings, but some aren't insured for the fire. What's worse and what bodes ominously for us is that a jump in rates may be upon us soon. According to the California Insurance Commissioner, Ricardo Lara, newly enacted rules allow for premiums to increase as insurance companies assess climate change risk. The state is issuing a one-year moratorium prohibiting insurance companies from dropping coverage in areas affected by fires. So that gives us a breather, but how much? Will this ultimately impact home prices? Remains to be seen. It's not all doom and gloom. We don't get the Santa Ana winds here and we usually see more precipitation here than there. Still, it's always possible that some other natural disaster strikes. So, with that said, we should all be prepared with a Go Bag. I've looked them up myself before but never actually put one together. My New Year's resolution is to create one for myself. Here's the contents you should consider... A "go bag" typically includes essential items which will allow you to evacuate quickly in an emergency situation and sustain yourself for a few days if necessary. Key items to include in a go bag: Communication and information: Battery-powered radio Cell phone charger Important documents (copies of ID, passport, insurance cards, birth certificates) Local maps List of emergency contact numbers Medical supplies: First aid kit Prescription medications Glasses or contact lenses (extra pair) Personal items: Change of clothes Toiletries (toothbrush, toothpaste, soap) Wet wipes Hand sanitizer Safety items: Flashlight and extra batteries Whistle Dust mask Work gloves Other considerations: Cash Pet supplies (if applicable) Multi-tool Portable battery pack Emergency blanket Essentials for survival: High-energy snacks Manual can opener (if needed) Water (multiple days supply) Non-perishable food Important points to remember: Regularly check your go bag: Ensure all items are current, not expired, and batteries are replaced when needed. Customize based on needs: Adapt your go bag to your specific situation and potential emergencies in your area. Keep it accessible: Store your go bag in a readily accessible location where everyone in your household knows where to find it. This all comes at a time when housing inventory is very low so this will create higher demand and we may even see residents of that area migrate to our area. ********************************** Let's chat about the market. There's not a lot of optimism with the state of rates for 2025, but buyers don't seem to be hampered and we're seeing the market waking up early this year.

Quieter but not Snuffed Out Here we are a week and a half until Christmas and the market shows a good deal of resilience. It's quieter but not still. The market in the next few weeks is going to do what it almost always does this time of year and that is slow down considerably. People who are selling tend to dislike people coming through their homes during the holidays when they have friends and family over, when the weather is wet, and when they may have expensive gifts under the tree. There are still sales though. I compared the numbers to last year at this time and prices were higher last year marginally even though interest rates were higher too. Houses were selling, on average, about a week faster too. The following shows the market compared to the week before and you'll see the slowing in the number of new listings which are down by 22%. Multiple offers ticked up again to 44% which reflects the demand from buyers against the reality of limited inventory. While cash purchases went down slightly, the number of FHA buyers went up. I've used this as a proxy for first time home-buyers. Not all first time home buyers buy with an FHA and not all FHA loans are to first time home buyers but it's a fair representation. If you're thinking of selling, reach out to get a better sense of the market in your particular neighborhood. If you're buying, the rates are projected to only marginally decrease so now may be an optimum time to start shopping. Reach out and let's chat.

I hope you all had a lovely Thanksgiving! I had a nice one with my family. 2025 and What to Expect When You're Projecting! O kay so, there's some knowns and some unknowns. It reminds me of the Johari Window. You know, the one. 4 quadrants of self-awareness: one quad known to yourself and others, the blind spot quad which is unknown to you, but known to others, the hidden quad which is known to yourself but not to others, and the Unknown - which is unknown to you and to others. But what does it look like when we're trying to get some awareness of the 2025 housing market...?

But wait. Are mortgage rates going down? Yesterday, the Fed lowered the federal funds rate by a quarter of a point as was expected. Did they achieve the soft landing? With recent events, that’s still up for debate. Everyone waiting for the mortgage interest rates to drop saw the market hit the snooze button. Today, we’re seeing a range of 6.25-6.75% for mortgage rates. Still about twice what the gold rush of the Pandemic Years brought. So what gives? Let’s take a look at something that did happen. The US 10-year Treasuries went up after the election. Here’s why that matters. The US 10-year Treasury notes are a proxy for mortgage-backed securities. Historically, the 10-year Treasury tends to move in unison with mortgage interest rates as you can see in the graph below. Investors that tend to buy mortgage backed securities also buy 10-year Treasury notes. The 10-year Treasury is impacted by many factors including: Overall economic conditions Financial Markets as a whole Inflation Interest rate moves by the Fed

The Family Trust It’s long been known that generational wealth unlocks doors – to opportunities and also to homes. Chances are your family didn’t bestow generational wealth on you to get into the best schools and the best homes. I wasn’t born into the 1% but if you are, kudos to you for being so lucky! Regardless of our station in life as parents (or grandparents), we usually want our children to enjoy some of the economic rights of passage that we’ve been fortunate to have – buying a house, getting an education, and/or just being prepared to earn a decent living. There’s many that will argue that it’s no different now than what it was many years ago, but I find that argument rings very hollow. We’re just not going to take sides here. I’ve talked to many adult children who feel the economic pinch and many a parent that sees it too. Becoming a homeowner has become especially difficult. Many millennials I’ve helped have had help from an inheritance from a parent or grandparent dying, they’ve managed to save for a down payment (no small feat), or they’ve gotten help through a living relative – usually a parent in the form of a gift for a down payment, being a guarantor, being a co-owner, or providing loans. Some refer to this living help as the Bank of Mom and Dad, but I like to think of it as the Family Trust. The definition of this trust is not the strict legal term but derives from these dictionary definitions: noun: the state of being responsible for someone or something. Verb: commit (someone or something) to the safekeeping of. But strikingly similar is the definition of a legal trust that acts as an arrangement whereby a person holds property as its nominal owner for the good of one or more beneficiaries. Look, I get it. Not all parents think one or more children deserve their trust because they haven’t shown good financial habits. I have one who is only now beginning to apply fiscal prudence to his life. But let’s say that you have a child that has demonstrated solid management of his/her own personal finances. You also probably have understood the good fortune to have purchased your own home when they were considerably cheaper than they are now and you’ve watched that purchase build your own wealth. Each mortgage payment along with appreciation, and the ability to utilize the deductions on your taxes have built a slow but steady accumulation of equity and personal wealth and stability that renters don’t generally have. So how do you help that child get their first foothold on the ladder to homeownership? A good way to start is to ensure that they are saving and are living below their means. Age brings a certain amount of perspective and wisdom about the need to be prepared for the unexpected such as job losses, costly emergencies, and just bad breaks that can impact a budget. If you feel the finances are being managed well, then the next order of business is to determine if and how you think you want to help. Here’s how others have built the home trust for their children. Down payment assistance as a Gift with the following in mind for IRS purposes. There’s a limit and for 2024, the maximum gift is $18,000 per person. This means that mom can gift the son $18k, dad can also gift the son $18k. If the son is married, mom and dad can gift $18k each to the spouse for a total of $72,000 per year without any additional reporting requirements. Thanks Ryan Elmer, owner of My Innovative Tax for providing this information! Giving Loan Assistance by being a Guarantor or a Co-Signer. Both can help a borrower with low credit scores or limited credit. Guarantors agree to cover a borrower’s debt if they fail to pay what they owe, but are generally not responsible for repayment unless the borrower completely defaults. As a Guarantor, the person’s credit is not impacted unless there is a default. Co-signers are basically co-owners of the mortgage. The loan appears on the Co-signer’s credit report and late pays show up just as they would for the primary signer. Just like the Guarantor, the Co-signer is responsible if the borrower defaults. Giving a loan to a child is an option, but if it’s a loan, it must be factored into the debt to income ratios to ensure the borrower is able to repay Buying a house in the parents’ name and putting it in a trust for the child is a great option especially if the adult child isn’t necessarily settled. In this case, the child pays rent for a house that they will own when the parents pass away. A word of caution – despite best intentions and love for your child, it’s best to pay an attorney to write the terms of the agreement. These are high level options and each individual should consider their specific situation and consult qualified tax and legal persons. I’ve seen each of them done successfully as well to help an adult child start on the first rung of homeownership. There’s also parents who buy rental properties when their kids are young with the object being to pay for a child’s college education when it’s time. I also kick myself for not buying a condo in San Diego when my oldest went to college there. It always seems more expensive at the time, but in hindsight prices went up exponentially. Learn from my missed opportunity!

Welcome the munchkins! I wish you a very fun and Happy Halloween! NEXT WEEK: The blog is going to cover the Bank of Mom & Dad. There's a fun event happening at our Keller Williams office for anyone that has kids or likes candy or likes to dress in costume. Please let me know if you plan to go so they have enough treats!