Blog

By Jane Gray

•

27 Feb, 2024

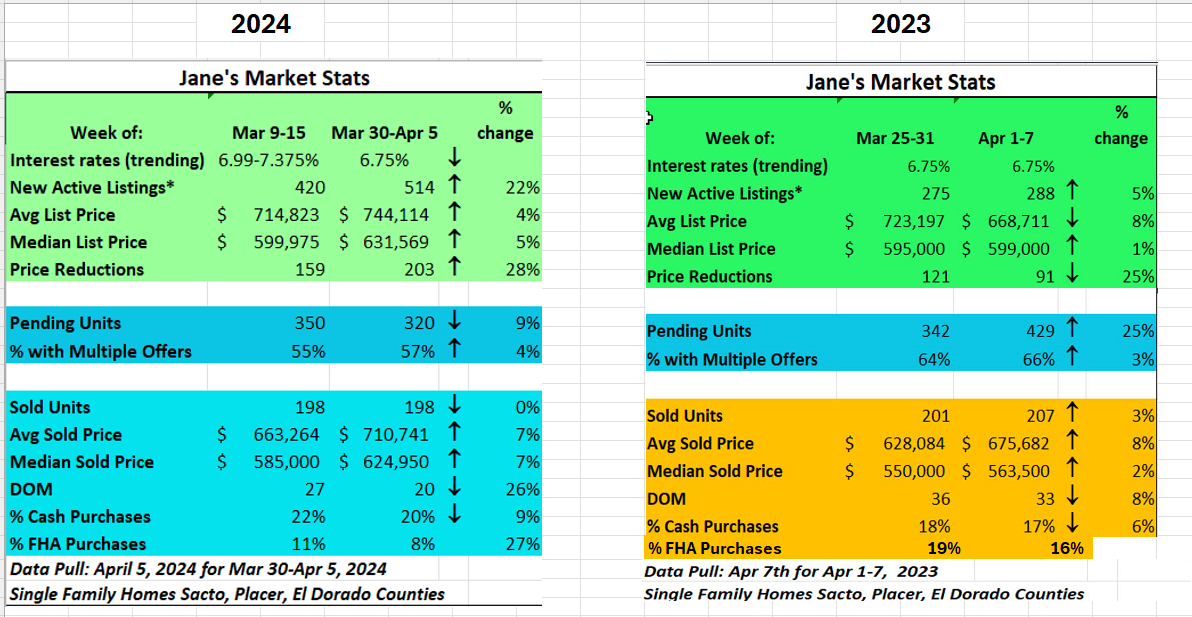

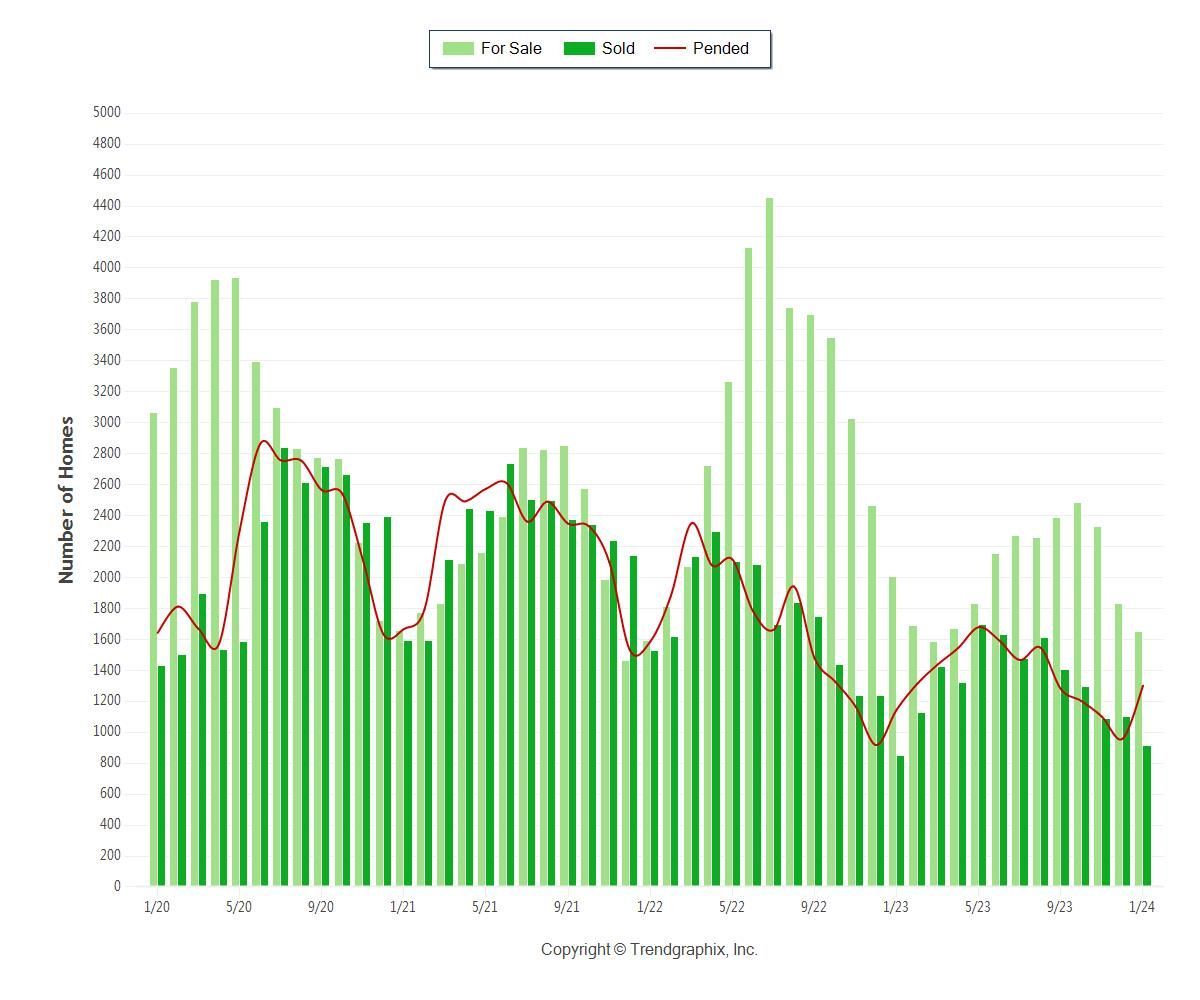

Are we back to normal? The above chart starts in January 2020 and we certainly thought at that time that it would be normal - early in the season, a bit slower, picking up and then moving into prime time. 2020 was anything but normal for both health and economic reasons. So what does "Normal" mean. Looking back, 2021 was an anomaly because of super low interest rates and then WHAM! The Fed started the raising interest rates at a rapid pace in March 2022 and here we are today feeling the rarified air of 7% interest rates. The thing to note is that it didn't stop the market. Let's take a look at a longer range. This chart shows us what happened when the housing market really crashed and it starts with Nov 2008. More houses (the light green) were on the market for years and up to 2020, the inventory was thinning out.

By Jane Gray

•

20 Feb, 2024

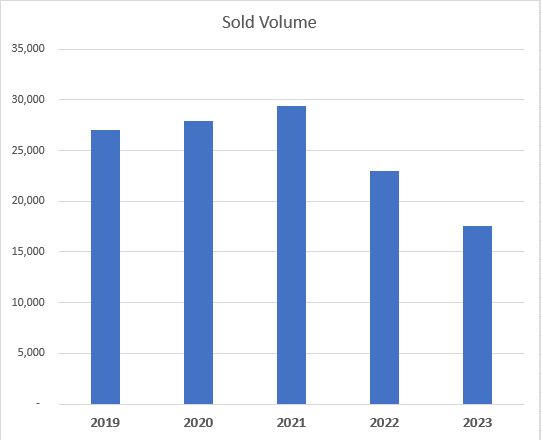

This is a top Google search when it comes to what people want to know about the real estate market. But, the question is, who's asking? There's a primary cohort that asks this on regular basis. Millennials who want to be homeowners but think prices are too high. I wonder if it's more appropriate to say that they are "hoping" that that the market will crash.. Comments include, "I'm going to wait until the market crashes to buy" or "when the market crashes, it will be a better time to buy". The fallacy of this belief is that a housing market crash includes a lot of other problems...stocks go down and people lose their jobs. So they want to wait for the rates and prices to be down. There's a mantra in the stock market that is just as applicable in the real estate market and that is "Don't try to time the market." Why? Well, there's some reasons you've heard of before but you may have forgotten.... 1) Let's assume you can wait. You have 3.5% or more for a down payment and you're just going to wait until the market dumps again because, "heck, it's cyclical. It can't keep going up forever!" On the flip side, you're paying rent. Rent continues to climb with housing prices usually and we've seen this especially here in Sacramento. Let's just say that your aim is a starter home for the average price of $630,000. Great! You're hoping the market will crash and it will only cost you somewhere in the high $400k range. And if and when you can time this, it could be such a feather in your cap, but what if you get laid off when the economy is down - there's no buying a house when you don't have income. 2) You don't know how long you'll have to wait. Here's why - we are at catastrophically LOW levels of housing for renters and buyers. There's just not enough housing stock which is one of the primary reasons that prices aren't succumbing to higher interest rates. Where are all the new houses coming from that are going to change the supply and demand balance to higher supply and lower demand that will cause prices to drop? Governments in California, nationally, and even internationally are trying this ADU thing and it's NOT enough. We are underwhelmed by the inventory that is coming online. Plus, there's a lot of potential sellers that are sitting on super low interest rates and they aren't wanting to sell. 3) When the market dumps - that means that homeowners are losing their homes! People that lose their homes sometimes DESTROY their homes - they pour cement down the plumbing, rip up cabinets, molding, tear out appliances. They are so angry that they are losing their home, they just seek revenge. Is that a home you can afford to buy and fix? 4) When the market crashes, your competition is Wall Street and other investors with CASH and no contingencies! They come in and scoop up lots of properties at low prices and they can fix things that are very expensive to fix for the average homebuying who's financing! It's true that interest rates do cycle up and down. Here's a view of average 30-year fixed rate mortgage rates from 2000. The great news is that when interest rates go down, you can refinance too. So, consider that if you have the ability to buy now, it might be a good time to buy rather than waiting for that market crash that may not be the dream come true you're hoping for!

By Jane Gray

•

09 Jan, 2024

It's a new year! Another Leap Year. An Election Year. The Summer Olympics in Paris. There's going to be another total solar eclipse April 8th. The Fed signaled that there may be three (3) rate reductions!!!! Hooray!!! In real estate, we have a strong start out the gate...Interest rates are trending down. Lots more listings coming on after the holiday season. We're seeing the listing side as an after-Christmas statistic moving up which is normal while pending and solds are still reflective of the holiday lull. There's a lot of people waiting on the sidelines - buyers waiting for interest rates to drop. Sellers are waiting for the same and more buyer demand. There's still activity and when it heats up again whether it's just the seasonal selling season which generally starts in March or the Fed dropping the interest rates by a percentage point, that's going to trigger more activity. If you are on the fence about selling: consider the things that you need to do to prepare to sell. Do you need paint, new flooring, repairs, landscaping? If you're a buyer thinking this might be the year to buy, get a copy of your credit report. Contact a lender to see what could be changed (paying off debt or taking care of credit issues). Your FICO score controls what rate you'd qualify for. Credit scores generally can't be fixed overnight so getting a head start will help you get that credit score in shape! If you want a real estate professional's opinion of what house-wise things need to be in order, let me know! Happy to help. I have several lenders that I recommend so if you need help figuring out the credit side, happy to refer you to someone that can help with that too! And keep in mind that if you're wanting to move to a different state, I'm tied in with a national network of professional agents and can find an agent or several for you to interview. I've been super busy myself - I sold my rental property in the DC area and have been busy moving, packing, and unpacking and then I got sick again - seems like the same thing I had last year so I've been busy lately, but I'm back and ready for another great year! Make it a great one!

CA BRE# 01973665

© 2024

All Rights Reserved | Jane Gray Real Estate | RE/MAX Gold

CONTACT US

FOLLOW US

© 2024

All Rights Reserved | Jane Gray Real Estate | RE/MAX Gold

Real Estate Web Design by Bullsai